More than half a century into the space age, commercial drivers are beginning to supplant military and geopolitical considerations in the exploitation of near-Earth space. How should we adapt our traditional institutions to benefit from and encourage this evolution?

Human beings are natural explorers, and space has always played to the human imagination; look at the long tradition of science fiction literature. The launch of the first artificial Earth satellite, followed four years later by the first man in space, resonated with the explorer in us all. But the primary impetus for the exploration of space was the Cold War rivalry of the USA and the USSR. The ensuing ‘race for the Moon’ was a staggering feat of both technological development and courage; but the legacy of government funding that was imprinted on space industries around the world is not best suited to the creation of a vibrant commercial market as we move forward.

The value of space in everyday life started to become apparent with the launch of the first communications satellites in the 1960s. Nowadays, weather satellites are taken for granted as an essential part of the forecasting process, while people rarely think twice about the satellite navigation systems that allow them to pinpoint their position on their smartphone or other portable device.

While satellite systems in near-Earth space have made the transition from novelty and convenience to being part of our critical infrastructure, we are still only in the first stages of realising their true potential. The events surrounding the loss of Malaysia Airlines flight 370 in March 2014 illustrate how important satellite capability can be, and are also a poignant reminder of what still remains to be done. Without the data picked up by Inmarsat’s communications satellites (receiving periodic maintenance information from the aircraft’s engines), which indicated that it had flown in a southerly direction for some six hours after regular contact was lost, the fate of the aircraft would have been even more of a mystery.

We would have the capability to routinely track aircraft from satellites much more precisely anywhere in the world if we had a suitable constellation of spacecraft. Such a capability already exists for shipping but has not yet been implemented for air traffic. Had such a system been in place, we would have been able to track MH370 and locate its crash site precisely and immediately.

We can already do a great deal with satellite systems. However, technical advances in communications systems, next generation satellite navigation with centimetre accuracy, and ever more sophisticated and accessible ways to monitor the Earth from space will have applications that we have only just started to glimpse. We can already see that these will include: agriculture and the management of natural resources; healthcare; transport and logistics; disaster management; energy; and even insurance and financial transactions. The economic potential of the new applications and services that will exploit space infrastructure appear unlimited. This should drive opportunities for satellite builders and providers, and leverage even greater spill-over benefits to the wider economy.

Commercially driven ventures are forcing established players to adapt to take advantage of the new space dynamic

Driven by these developments we are seeing an increasing diversification of a space industry historically dependent on large governmentfunded programmes. Commercially driven ventures are forcing established players to adapt to take advantage of the new space dynamic. However, all of this depends on coming up with the right economic model, and we still have some way to go before this is achieved.

The greatest economic returns are to be found in the services and applications that satellite infrastructure enable

One issue is that the greatest economic returns are to be found in the services and applications that satellite infrastructure enable, rather than in the construction of the satellites themselves. And it is still expensive to develop and launch the infrastructure. For this reason, global satellite navigation constellations like Europe’s Galileo or the next generation GPS constellation in the US are being built with public funds, with no direct connection to the businesses that will ultimately benefit from the use of these constellations.

Making space data accessible

Satellite imagery of the Earth is becoming ever more sophisticated. A wide variety of data are now available in a range of spatial resolution, geographical coverage and time resolution. These images can be obtained in a variety of colours. Radar imaging, which has the benefit of being able to penetrate cloud cover and which works equally well at night, is also becoming more commonplace.

The potential for Earth observation (EO) based applications is massive; however, the images themselves are of limited use – it is the information they contain that has commercial value, and extracting that information in a cost-effective way is the key to realising the potential. Understanding what the images are telling us, and extracting the information we need from them in a reliable way, is a complex process. Combine this with the plethora of spacecraft providing the data, each with different characteristics and instrumentation, and the challenge for any company starting out to develop a new EO information service is formidable.

CEMS – Climate & Environmental Monitoring from Space - is designed to help companies over these initial hurdles, offering the ability to experiment and develop new commercial services without having to make a prohibitively expensive investment in facilities and expertise. The name shows the programme’s origins as a facility to help scientists to understand the long-term evolution of the Earth’s climate. It was soon realised that this concept was needed in the commercial world and that a combination of cutting-edge research and commercial rigour could be a powerful platform for growth. Climate and environmental scientists at the University of Reading and at RAL Space joined forces with Logica (now CGI) and Astrium Geoinformation Services Ltd (now Airbus Services) to develop the idea. The infrastructure was funded by a grant from the UK Space Agency under the management of the International Space Innovation Centre (ISIC) at Harwell Oxford, and CEMS is now offered as a facility for both scientific and commercial use by the Satellite Applications Catapult, ISIC’s successor.

Combining a large data storage capacity with substantial computing power, CEMS has the ability to cope with the very large volumes characteristic of EO data and their complex analysis. Companies can buy time on CEMS on a pay-per-use basis, meaning that they can develop their applications rapidly and responsively without having to invest in infrastructure. CEMS data products also come with a measure of how accurate they are, which allows companies confidently to offer quantified information to customers. Moreover, users have access to the expertise of the scientists behind CEMS and their latest research, which means they can offer cutting-edge products. CEMS is an excellent example of how industry and the research community can work together to add value, combining expertise to create a groundbreaking product.

While creating the infrastructure for the public good is undoubtedly an excellent and appropriate use of taxpayers’ money, such public procurements inevitably lack the commercial edge that drives down cost and improves performance.

The commercial communications satellite market is more mature with a simpler relationship between satellite builders and the operators that provide communications services. The operators have a business model in which they can sell communications services directly to customers, earning the revenues that allow them to procure satellites directly.

One example is the UK company, Avanti Communications, which was able to raise money in the City of London to fund the procurement of satellites that are now providing broadband services. Government bodies are also realising that it can be more effective to procure a communications service rather than building a satellite, as in the case of the UK Ministry of Defence, which is using Paradigm Ltd as a service provider for its secure communications needs.

But even in the area of communications satellites, public funding is often relied on to take the risk out of technology development. An example of this is the European Space Agency’s Advanced Research in Telecommunications Systems programme (ESA ARTES). And there is also the time challenge: how to speed up the typical five-year timescale between the conception and the launch of new satellites so as to match the rapidly evolving applications market.

Earth observation

In the Earth observation (EO) field there is a mixed economy. The EU is funding a major series of satellite platforms through its Copernicus programme, while the US has its longestablished Landsat series of satellites. However, a growing number of private companies are now operating their own satellites and selling data and data products to end users. Earth observation data, though, can be complex and difficult to interpret, and there is work to be done to make the information it contains available to the very broad market that could potentially benefit from it.

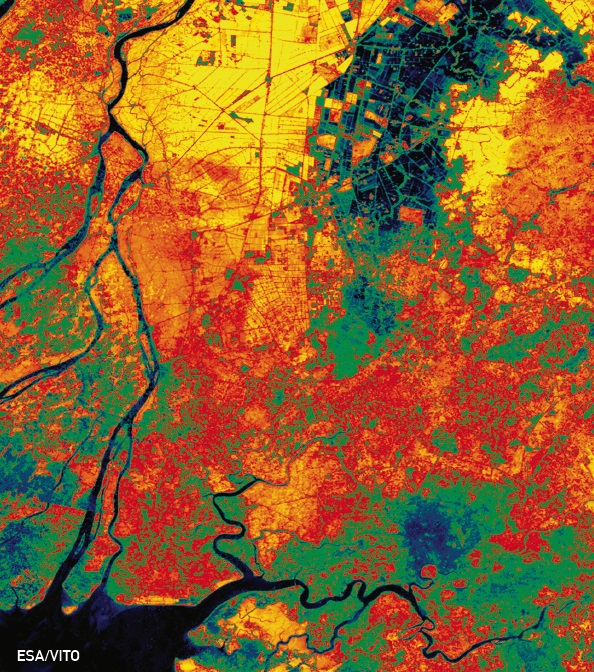

Coloured vegetation index of the MekongDelta, Vietnam

Coloured vegetation index of the MekongDelta, Vietnam

Against this background, what steps can be taken to accelerate the development of the space market along lines that stimulate economic growth? In the UK, we have focused on creating greater coherence, breaking down those institutional barriers that evolved to suit a different era; and on proactive steps to raise awareness and stimulate demand in the broad range of sectors that could benefit from using space solutions.

A key step is to enable a rapid and responsive exchange of knowledge between research communities and end-users, incorporating the expertise of industry in providing practical and economically viable solutions. This is especially important in the field of EO, where development and understanding are proceeding apace.

Nurturing innovation

As any parent will testify, travelling with a baby can be a nightmare because of all the associated paraphernalia. Travel cots in particular are often heavy and difficult to transport, and can be less than straightforward to assemble or disassemble.

Now an innovation based on technology developed for satellites promises to make life on the road with baby a more enjoyable experience. Start-up company Oxford Space Structures has used technology designed to deploy folding structures on the European Alphasat spacecraft to design a lightweight, easily folded and unfolded travel cot.

As a spin-off of the Said Business School in Oxford, Oxford Space Structures successfully applied to the ESA Business Incubator Centre (BIC) at Harwell Oxford after winning a ‘hackathon’-style event for students called Future Business Pre-Incubator. However, to transform its idea into a commercial business, the fledgling company needed access to business support, funding and contacts – which can often be difficult and time-consuming to secure.

Through the ESA BIC Harwell’s support package and the networking opportunities at Harwell Oxford, Oxford Space Structures has gained valuable opportunities to access business skills workshops in areas such as intellectual property (IP) and strategy, to help it develop its design further into a physically marketable product.

The close links with ESA also enabled the company to gain additional support from ESA’s IP/technology inventors in the Netherlands to understand better the technology and the advantages and drawbacks of incorporating it into the product. It has had the opportunity to collaborate with the University of Delft in the Netherlands to gain additional support, which has further benefited its business; and recently the company secured funding from the Satellite Applications Catapult at Harwell Oxford to help it to construct a demonstration version of its product.

Since joining the ESA BIC Harwell and accessing these opportunities, Oxford Space Structures has grown rapidly. The support it has accessed has enabled it to expand its team, enhance its reputation through its association with ESA and secure investment and technical partners.

As a result, it has been able to develop its design concept into a product that will soon be available to harassed parents!

The International Space Innovation Centre (ISIC) at Harwell Oxford was specifically set up as a partnership between industry, the public sector and universities to stimulate closer interaction; the rapid translation of research knowledge into commercial solutions; and the stimulation of new research by real-world problems. One of the outcomes was the creation of a new facility, Climate & Environmental Monitoring from Space, or CEMS (see inset), to provide companies with the ability to develop new commercial applications based on EO data, informed by the latest research knowledge, and without having to invest in very expensive infrastructure to handle and process large volumes of this data.

A further role of ISIC was to reach out to a broad range of sectors that were not traditional users of space data, including transport, energy, healthcare, insurance and financial institutions, to raise their awareness of how space could help improve their business. It rapidly became apparent that even when companies were aware of space, they lacked the skills to keep up with the rapid pace of technical change and implement appropriate solutions.

For many space service start-ups, access to the global market is vital

Personnel from ISIC, and its evolution, the Satellite Applications Catapult, are able to guide them through the technical issues, identify areas where space can provide a solution and put them in touch with the right experts who can implement these solutions.

A global business

Turning to the development of new applications and services based on the expanding space infrastructure, history suggests that the main engine of growth is likely to be new, focused, innovative companies that are best positioned to seize the emerging opportunities.

There may be useful analogies with the growth of internet-based companies in the 1990s (the so-called ‘dot com boom’), and associated lessons to be learnt, such as developing a robust business model from the outset that maximises company survival rates. In the space field, there is also the issue of taking the risk out of the adoption of new technologies to the point where they can attract sustainable commercial investment.

Such companies are likely to thrive best when they are embedded in an environment where they have ready access to the most recent innovations and technical developments, and to appropriate technical support. Clusters of such activity should develop around existing centres of expertise. The advantage of these clusters is that common business support mechanisms can be developed that take advantage of the economies of scale of the cluster to provide tailored support for individual companies at a reasonable price.

This would include management and financial advice as well as access to investors. While companies with the best ideas may prosper and grow in a process of ‘natural selection’, it is also important that good ideas get the opportunity to germinate and that unnecessary company failures are minimised through appropriate support mechanisms. This is good both for investor confidence, and also for creating a forward-looking and innovative environment where entrepreneurs are willing to take risks.

Another advantage of clustering is the potential to share facility and development costs. The case of CEMS has already been highlighted, where an environment for developing new applications based on EO can be accessed on a pay-as-you-go basis, without having to make a substantial up-front investment in facilities and expertise that would be out of the reach of a small company.

Similar interventions can be designed for other areas, for example, test rigs based on the latest generation of communications satellite or navigation technology that allow small companies to trial, develop and demonstrate their new applications in a representative environment.

The final important element is access to the market facilitated by international strategic alliances. Space, inevitably, is a global business. Satellites, particularly those in low-Earth orbit, transcend national boundaries and new applications and services based on their use have a marketplace that is worldwide.

More importantly, if a company were to offer a space-enabled service on a restricted geographical basis it would leave itself open to competition from rivals that did operate globally.

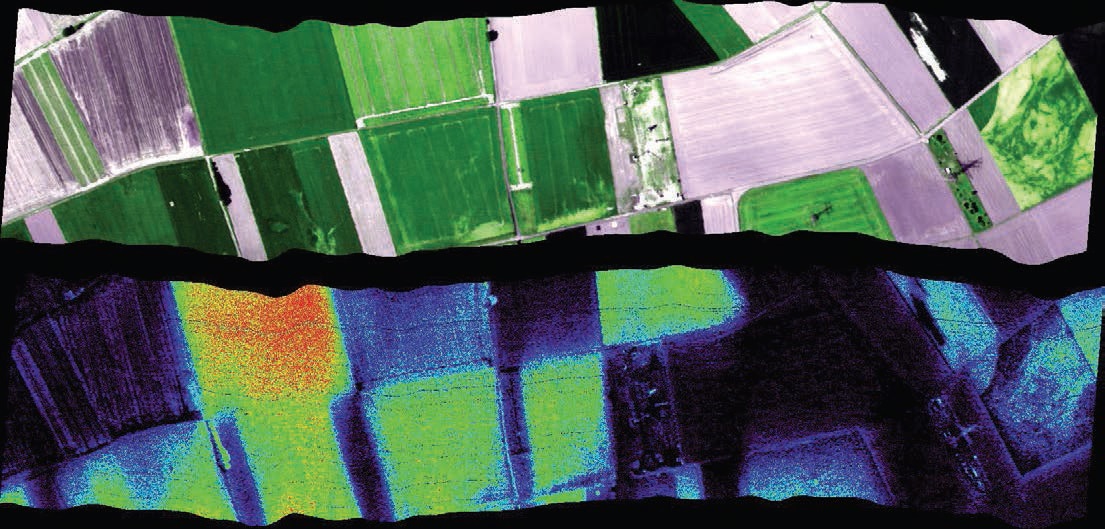

An image taken by ESA’s Earth Explorer FLEX mission, showing fluorescence from different types of vegetation. FLEX provides information on photosynthetic activity, which can improve our understanding of the amount of carbon stored in plants and their role in the carbon and water cycles, and is also used to optimise agricultural productivity

An image taken by ESA’s Earth Explorer FLEX mission, showing fluorescence from different types of vegetation. FLEX provides information on photosynthetic activity, which can improve our understanding of the amount of carbon stored in plants and their role in the carbon and water cycles, and is also used to optimise agricultural productivity

Thus, for many space service start-ups, access to the global market is vital, and it is in the mutual interest of high-tech clusters around the World (such as Boston MIT and Silicon Valley in the USA; Greater Shanghai; and the UK Golden Triangle of Cambridge, Oxford and London) to co-operate with each other to facilitate this access.

The Golden Triangle includes the Space Cluster at Harwell Oxford, which is an exemplar of the new approach to space growth promoted by its key stakeholders and providing SMEs with access to cutting-edge facilities and to incubator/business support capabilities.

In summary, the exploitation of near-Earth space has come a long way in the past halfcentury. From its origins in government programmes, space now has an increasingly commercial focus, and one that is strategically important for all the world’s economies.

For satellite builders and those that provide other elements of space and the supporting ground-based infrastructure, including launchers, there is an evolution away from exclusively government-funded contracts to a customer base consisting of a plethora of service and applications companies operating in a highly competitive global environment.

The pressure to reduce costs, and improve response time, should benefit all and itself contribute to an expansion of the marketplace. Chances are that by 2057, space will be as different from now as the present day is from 1957 when it all began.