Unless some highly disruptive technological discoveries emerge, access to space will always remain a significant bottleneck for the global space industry. As demonstrated by the rash of launch failures in the first half of 2015, boosting satellites to orbit is by no means a trivial endeavour. These events have also demonstrated that no nation’s space programme is immune to the challenges associated with successfully lifting objects to orbital velocities well above one kilometre per second, especially from countries that have pioneered the space lift industry and have been launching for more than a half-century.

Unless some highly disruptive technological discoveries emerge, access to space will always remain a significant bottleneck for the global space industry. As demonstrated by the rash of launch failures in the first half of 2015, boosting satellites to orbit is by no means a trivial endeavour. These events have also demonstrated that no nation’s space programme is immune to the challenges associated with successfully lifting objects to orbital velocities well above one kilometre per second, especially from countries that have pioneered the space lift industry and have been launching for more than a half-century.

Since the launch equation will always remain the launch equation - and because this necessitates highly complex engineering solutions with numerous interconnected components for systems that must endure the harshest conditions - the cost of launch is likely to remain relatively high, even for the most promising of the new launch systems that are emerging in the global market.

With the boom in smallsats comes an increasing demand for launch opportunities

Nonetheless, the international space industry should still experience a reduction in launch costs with the employment of innovative technologies and launch approaches. This article presents a balanced discussion on the trend of the increasing number of small launch vehicles (LVs) being developed to meet the increasing demand for small satellite launch worldwide.

Increasing demand

The international space industry has seen a significant increase in interest in small satellite (smallsat) capabilities to meet the seemingly insatiable global interest in space-based capabilities, such as earth observation (EO), communications and terrestrial weather forecasting data. This up-swell of demand of smallsat technologies and services is a result of the convergence of at least four major factors (Figure 1).

Figure 1 - Key contributors that drive the expanding smallsat market.

Figure 1 - Key contributors that drive the expanding smallsat market.

The synergies of the accelerating advancement of technologies and innovative methodologies and the observable trend of Moore’s Law driving miniaturisation of hardware has created a technological basis that has enabled smaller satellite systems to accomplish useful and operational capabilities.

Furthermore, the global economic downturn that began in 2008 has driven decision makers of legacy space programmes to consider more effective and economical methods to build, launch and operate satellite systems and capabilities.

Naturally, there has been a surge of interest in considering how smallsats play into the equation of lower cost space architectures because of the fact that the spacecraft development costs for these smaller systems are significantly lower than for larger aggregated systems. Moreover, a tremendous amount of market interest has been generated in the past year or so in the promise of capabilities that could be brought about by smallsat systems and architectures.

Forbes magazine reported that US$2.5 billion has been invested in the commercial smallsat industry in the past 10 years, with over half of the investment dollars being sown in the past two years [1]. These investments are in commercial operational smallsat projects, not merely technology demonstration and basic science experiments made by government space organisations. And they provide a broad spectrum of capabilities, such as multispectral and hyperspectral imagery, weather data collection, GPS radio occultation and video.

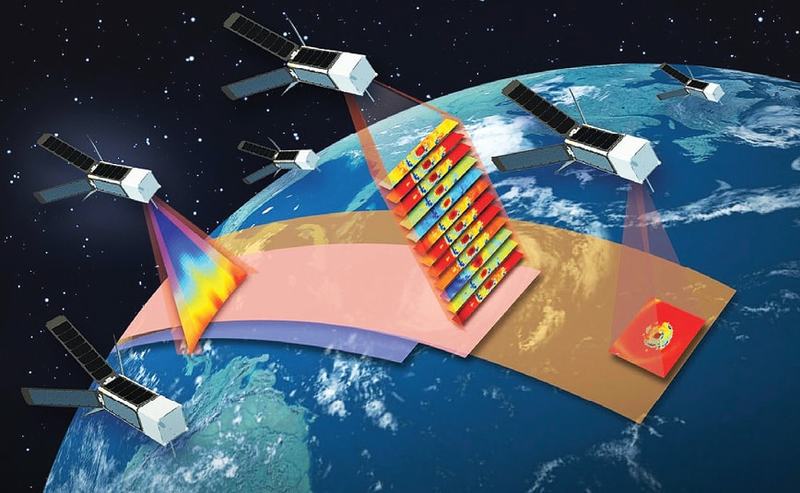

With the boom in smallsats comes an increasing demand for launch opportunities. The majority of the current smallsat architectures are designed for low Earth orbit (LEO) altitudes, which require a larger number of spacecraft in a constellation to provide faster revisit times and global coverage. Therefore, with the growth of the number of smallsat spacecraft follows an increased requirement to place these large constellations of small spacecraft in a wide set of locations.

Out of the woodwork

As the smallsat market continues to burgeon, many international companies are emerging with different systems and methodologies to meet the growing demand for access to space for these smallsat constellations. The three primary means to getting smallsats to orbit are dedicated small LVs, ride-sharing of free-flying spacecraft and hosted payloads (Figure 2).

Figure 2 - Three components of smallsat access to space.

Figure 2 - Three components of smallsat access to space.

Although the latter two options for small payload launches are not addressed specifically within the scope of this article, it is important to note that innovations in these areas are also increasing as a result of the rising launch demand for smallsats.

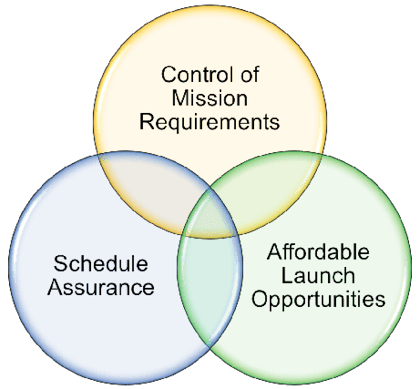

Despite the cost savings compared to other approaches, many commercial spacecraft providers are demanding more control over mission requirements that are otherwise relinquished when flying as secondary spacecraft with respect to a primary spacecraft on a rideshare mission. This phenomenon is represented in Figure 3.

figure 3 - three balancing factors for spacecraft providers choosing launch options.

figure 3 - three balancing factors for spacecraft providers choosing launch options.

Since these commercial smallsat providers have requirements to deliver their spacecraft to particular orbits to build their constellations, many of them are seeking dedicated launcher options instead of being subject to the requirements of a primary mission. These commercial companies also desire schedule reliability in order to ensure that their systems are launched and deployed to market at a time of their choosing. Ride-sharing is not conducive to schedule control for smallsat payloads, compared to dedicated launch.

Nevertheless, finances balance out the increasing demand of operational control and schedule reliability. Many of the emerging smallsat system providers are not able, or do not desire, to purchase an entire medium to large LV, ranging from US$60 million to US $120 million. Even the price point for smaller to medium class boosters - such as Orbital Sciences Corporation’s Minotaur C and the Indian Polar Satellite Launch Vehicle - are high enough to deter a single spacecraft provider from purchasing an entire booster for themselves.

Many commercial spacecraft providers are demanding more control over mission requirements that are otherwise relinquished when flying as secondary spacecraft

These factors have sparked an enormous interest in finding lower cost and dedicated launch capabilities, particularly in the small LV market. In their paper entitled ‘Small Launch Vehicles- A 2015 State of the Industry Survey’, Carlos Niederstrasser and Warren Frick presented a survey of 22 emerging small booster systems, and Nathaniel Crisp, et al, detailed a list of emerging small LVs in their paper ‘Small Satellite Launch to LEO: A Review of Current and Future Launch Systems’ [2,3].

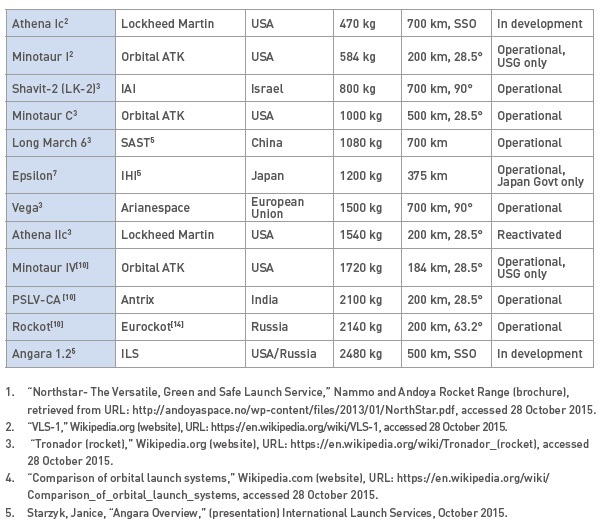

The table opposite provides a list of current and future small LVs, compiled from multiple sources. It is not intended to provide a comprehensive presentation of all small LVs available in the market to date and/or in the near future. The data is based on publically available information in several papers, internet research, and releasable data made available through personal contact with the LV providers. Additionally, the author has been made aware of several other small launchers that are not yet ready to provide public details on their proposed launcher systems.

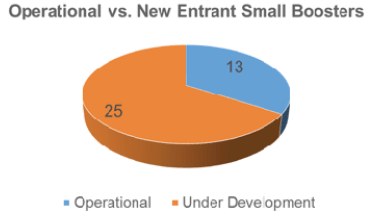

The listing in the table is arranged from the smallest lift capability up to boosters that can lift 2500 kg to low LEO. As represented in Figure 4, of the 38 entries, 13 are currently operational and 25 are currently under development, aligning with the aforementioned premise that there is an increasing interest in this class of launchers.

Figure 4 - Breakdown of operational versus new entrant small launch vehicles.

Figure 4 - Breakdown of operational versus new entrant small launch vehicles.

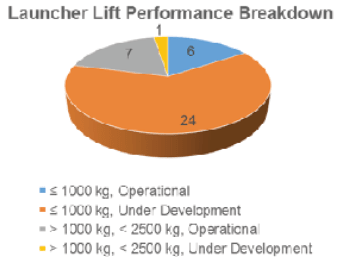

Even more notable, 30 small launchers are identified as less than or equal to 1000 kg in lift performance (Figure 5) and 24 of them are new entrants to the market under development. There is only one booster (the Angara 1.2, a projected replacement for the Dnepr) under development for boosters with lift performance between 1000 and 2500 kg versus the existing seven small launchers in that band. These trends seem to indicate that interest is for dedicated launch for the direct injection of single or very small numbers of ridesharing smallsats. As can be seen, there truly has been an immense boom in prospective small launchers across the globe.

Figure 5 - Breakdown of small launcher lift performance.

Figure 5 - Breakdown of small launcher lift performance.

Balancing optimism with reality

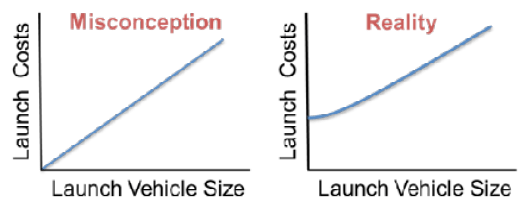

The reality of launch costs begs the discussion of the contributory factors. According to this author’s paper ‘Changing the Access to Space Calculus for SmallSats to Enable Industry Paradigm Shift’, there is a general misconception that the cost of launch is directly proportional to the size of the launcher (Figure 6).

Figure 6 - Reality versus misconception of the cost of launch with respect to LV size.

Figure 6 - Reality versus misconception of the cost of launch with respect to LV size.

In essence, a launch vehicle mass of zero kilogrammes doesn’t equate to zero costs. The fact of combined costs of booster design, production, launch, logistics and infrastructure drives up the base cost of launch of even the smallest of booster systems. Therefore, as shown in the right plot of Figure 6, the threshold cost of launch will almost inevitably be relatively high, even for small launch vehicles, due to the immense difficulty in lofting spacecraft to orbit, barring major scientific breakthroughs.

In reality, smaller dedicated LVs are competing in the market with larger booster missions as both dedicated rideshare (aka cluster) and traditional ride-sharing (aka piggy-backing) consisting of secondary smallsats attaching themselves to a primary launch mission. The challenge lies in the fact that the larger the LV, the ability to divide up the launch costs between multiple smallsat rideshares increases, thus driving down the cost of launch for each individual smallsat.

Many larger LV providers are hesitant to embrace ridesharing of all types due to the complexity of multiplespacecraft manifests

Several papers written on this subject have noted that the cost per launch for small satellites generally increases as the size of the LV decreases, utilising a metric called ‘specific cost’ measured in price per kilogram. In their other paper, Crisp et al, note that “the specific cost of payload delivered to orbit… has been shown to decrease as the payload capability of the launch vehicle increases.” They utilised a metric called ‘payload impulse’ - ‘the total momentum provided to the payload’, when compared between launchers, revealed a basic trend of the inverse relationship between LV capability and the price per kilogram.

Interviews with key players in the industry seemed to indicate a wariness in the reality of the small launch market. Every respondent expressed concern that it seemed that there have been almost too many new small LV entrants and the market will become quickly saturated by dedicated launch options for smallsats.

One well established LV provider stated, “a natural thinning out of the small launcher market is to be expected”. The provider noted that many of the new players require “a high launch rate to achieve [their] aggressive price goals”, and that there exists a bit of “un-reality on what it takes to do space launch… but they’ll learn… the details of what it takes to launch are very costly; it is more than just a rocket and the gas tank.” Several other respondents expressed similar sentiments.

Despite all of this, the market has shown that some smallsat providers have been willing to pay a bit more to gain operational control and more schedule assurance by purchasing a dedicated launcher, such as Skybox Imaging’s purchase of an entire Vega booster [10]. However, in their paper, ‘Launch Deployment of Distributed Small Satellite Systems’ [11], Crisp et al, note that many of the smallsat players may “not be able to economically justify the use of dedicated launch vehicles”.

The market is further balanced by the fact that many larger LV providers are hesitant to embrace ride-sharing of all types due to the complexity of multiple-spacecraft manifests. Many of the larger booster providers have begun referring small spacecraft providers to third-party integrators that aggregate rideshare missions to alleviate the burden on the booster providers. Furthermore, many primary spacecraft providers are hesitant to allow traditional secondary rideshares on their mission for fear of perturbing their costly missions. These factors drive the pendulum back in favour of small boosters.

Force for the future

The dedicated small launcher segment of the market is a key to opening up space for more users

In order to bring down further the cost of small boosters, the small launcher industry should continue to pursue newer technologies and methods to put satellites on orbit. One interviewee noted that the majority of the launch industry is “relying too heavily on known technologies for use in newer systems”, which is obviously a prudent and conservative approach. They recommend, however, that the industry should continue to consider how to infuse innovative technologies and streamlined methodologies into future systems and missions, to include 3D printing in space, hybrid motors and other disruptive ways to monetise systems to bring to market.

Effort must be made to reduce the cost of launch to make space accessible to more people. One space investor succinctly stated, “It only takes 15 students in a lab to make a satellite but so much more effort to launch that satellite. The LV side must become quicker, cheaper, easier.”

Spaceflight Industries (Spaceflight), one of the companies reinventing the model for launching small satellites into space, recently announced the purchase of a SpaceX Falcon 9 rocket and the expansion of its launch services to include dedicated rideshare missions. Its first dedicated rideshare mission, named the ‘2017 Sun Synch Express’ will launch in the second half of 2017 to a sunsynchronous Low Earth Orbit (LEO), which is popular for Earth imaging satellites.

Spaceflight Industries (Spaceflight), one of the companies reinventing the model for launching small satellites into space, recently announced the purchase of a SpaceX Falcon 9 rocket and the expansion of its launch services to include dedicated rideshare missions. Its first dedicated rideshare mission, named the ‘2017 Sun Synch Express’ will launch in the second half of 2017 to a sunsynchronous Low Earth Orbit (LEO), which is popular for Earth imaging satellites.

This is interesting to note because the relative cost of developing an individual small satellite is becoming significantly lower than the cost to put that satellite in orbit. For instance, in a web article ‘CubeSats explained and why you should build one’, the author explains that a ballpark 1 kg 1U CubeSat costs “typically less than US$50,000” to build [12]. Therefore, if a 5 kg 3U CubeSat costs approximately US$100,000 to US150,000 to build - and the general market price for a 3U CubeSat to launch is over US$300,000 - then the cost of launch is two to three times larger than the price to build that satellite. The industry must continue to strive to find ways to further reduce the cost of launch.

The Time-Resolved Observations of Precipitation structure and storm Intensity with a Constellation of Smallsats (TROPICS) investigation, 12 CubeSats about a foot long each, will study the development of tropical cyclones by taking measurements of temperature, precipitation and cloud properties as often as every 21 minutes.

The Time-Resolved Observations of Precipitation structure and storm Intensity with a Constellation of Smallsats (TROPICS) investigation, 12 CubeSats about a foot long each, will study the development of tropical cyclones by taking measurements of temperature, precipitation and cloud properties as often as every 21 minutes.

All in all, the global space industry is experiencing a need to balance the three requirements of operational control, schedule reliability and affordability of launch to bring the best access-to-space solution for its particular needs. Space launch must become ‘commoditised’ and become both predictable in frequency and price for small satellites, as well as being relatively ‘agnostic’ in terms of launcher or method of space access. The dedicated small launcher segment of the market, in conjunction with hosted payloads and traditional and dedicated rideshare, is key to opening up space for more users. Creating such an environment will open the proverbial floodgates for space technological innovation and affordable modernisation of aging space architectures.

Daniel Lim is President and CEO of Xtenti, LLC, a new solutions provider seeking to bring disruptive enablers for the space industry and create tangible solution sets that intersect the space industry with other non-space industries. He has over 15 years of experience in systems engineering and design on major government and commercial programmes, including mission integration for numerous government space missions. This article is an adaptation of the paper presented at the 2015 Reinventing Space Conference.

References

1Dillow, Clay, “Here’s why small satellites are so big right now,” Fortune (online article), URL: http://fortune.com/2015/08/04/small-satellites-newspace/, cited 4 Aug 2015.

2Niederstrasser, Carlos and Warren Frick, “Small Launch Vehicles- A 2015 State of the Industry Survey,” Orbital ATK, Inc. (conference paper), Small Satellite Conference, Logan, UT, 2015.

3Crisp, Nicholas, K. Smith and P. Hollingsworth, “Small Satellite Launch to LEO: A Review of Current and Future Launch Systems,” 29th International Symposium on Space Technology and Science (conference paper), Nagoya-Aichi, Japan, 2013.

4“Northstar- The Versatile, Green and Safe Launch Service,” Nammo and Andoya Rocket Range (brochure), retrieved from URL: http://andoyaspace.no/wp-content/files/2013/01/NorthStar.pdf, accessed 28 October 2015.

5“VLS-1,” Wikipedia.org (website), URL: https://en.wikipedia.org/wiki/VLS-1, accessed 28 October 2015.

6“Tronador (rocket),” Wikipedia.org (website), URL:https://en.wikipedia.org/wiki/Tronador_(rocket), accessed 28 October 2015 .

7“Comparison of orbital launch systems,” Wikipedia.com (website), URL: https://en.wikipedia.org/wiki/Comparison_of_orbital_launch_systems, accessed 28 October 2015.

8Starzyk, Janice, “Angara Overview,” (presentation) International Launch Services, October 2015.

9Lim, Daniel, “Changing the Access to Space Calculus for SmallSats to Enable Industry Paradigm Shift,” 2015 AIAA Space Conference (conference paper), Pasadena, CA, September 2015.

10Svitak, Amy, “Arianespace’s Vega to Launch Four Skybox Imaging Sats In 2016,” Aviation Week.com (web article), http://aviationweek.com/space/arianespace-s-vega-launch-four-skybox-imaging-sats-2016, 17 March 2015.

11Crisp, Nicholas, K. Smith and P. Hollingsworth, “Launch Deployment of Distributed Small Satellite Systems,” University of Manchester, UK, 4 November 2014, p.1.

12“Cubesats explained and why you need to build one,” DIY Space Exploration (web article), URL: http://www.diyspaceexploration.com/what-are-cubesats/, accessed 29 October 2015.