Investment in space systems and space technologies by venture capitalists is on the increase and the industry is benefiting as a result. In an article based on his presentation at the Asgardia Space Science & Investment Congress (ASIC), Mark Boggett explains why this transition from government to private funding is underway and provides a growing list of investment examples.

Intrepreneurs are creating satellites that are smaller than those the leading manufacturers produce (and typically cost hundreds of millions of dollars each) but have much of the functionality for a fraction of the cost. Why is this happening? Because the companies that build those hundred-million dollar satellites cannot suddenly change their processes to work with the latest technologies and, historically, have not been interested in innovation. The reason for this is that innovation means risk: each time they change a component it brings an element of risk to the satellite they’re producing. So because they are risk averse they’ve become innovation averse.

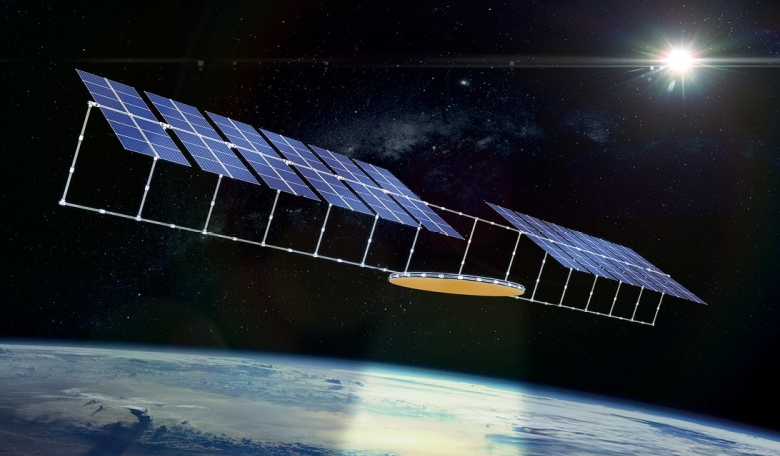

What has changed is that a whole bunch of entrepreneurs have seen a massive opportunity in space and are putting together these satellites, the size of a shoe box or a washing machine, and competing head on with the manufacturers of the large satellites. This has created a disruption in the market that venture capitalists are keen to make money from.