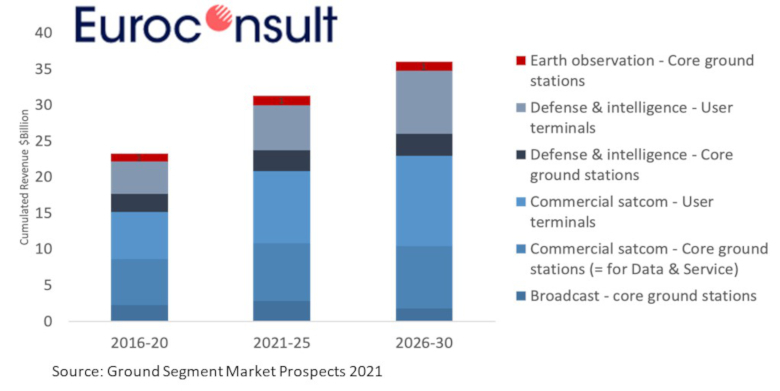

The downstream space market is witnessing a significant increase in the number of ground stations for the commercial satcom and EO markets, with overall revenues forecast to reach US $7.5 billion by 2030, driven by the rapidly expanding demand for data services and user terminals. And while the broadcast element has declined, this is being offset by the growth in the data services segment.

International consulting and market intelligence firm Euroconsult has released a new report analysing revenue opportunities specifically in the Satcom, Earth observation (EO) and Defence sectors in response to is rapid growth and growing interest in the ground segment market.

Ground Segment Analysis 2021 captures the latest trends and offers insights for those looking to either take advantage of this developing market sector with their own ground segment capabilities or looking at 'Ground Segment as a Service' options.

It incorporates defence market opportunities along with an analysis of the impact of COVID, and provides a strategic overview of all ground-based elements for key downstream services, assesses global ground station trends and user terminals for EO and Satcom applications, examines key players and provides commentary, analysis and forecasts for the main opportunities and threats in this area.

With several key demand drivers for the growth in ground segment activities, the report satest that the accelerating demand for consumer broadband and mobile has resulted in the user terminal market offering major growth opportunities, with value predicted to more than double to $2.7 billion by 2030.

The report contrasts the rapid growth with that of traditional ground stations and explains capacity demand and the enabling effect of flat panel antennas in comparison with VSAT terminals, as well as the phased array/electronically steerable antenna sub-segment where its growth in potential value for tracking multiple satellites in the maritime and aerospace sectors is forecast.

Euroconsult's analysis highlights the need for more ground station facilities positioned to take advantage of the proliferating LEO satcom market, along with the historical lack of funding at mid-latitudes, resulting in a more recent large increase in ground stations at locations more diverse than previously developed.

Uniquely, for this domain, the defence market is also assessed, detailing extensive US opportunities and the lesser demand in Europe and Asia. Findings reveal peak investment in user terminals coincided with Middle Eastern conflicts, with slightly lower investment in recent years.

The report highlights how this situation will change from 2023, with new investment in the billions of dollars expected. The impact of commercial services such as Starlink and OneWeb on the military market is analysed, whilst the possibility of industry managing it as a service is also explored.

Pacôme Revillon, Euroconsult CEO stated: "The ground segment ecosystem is at a turning point, driven by technology innovation and changes in demand patterns from private and government clients. We have strengthened our research and strategic analysis to capture the unique dynamics of the ground segment industry."

Analysis of the broadcast segment indicates major changes in the next decade via terrestrial competition, a temporary boost to the market as a result of frequency reallocation in the US and the growth in the data (broadband internet and IOT) sectors. With newer High Throughput Satellites (HTS), new antennas will be needed to track mega constellations, driving a huge demand in new frequency needs. The report looks at the growth in the size of ground stations to cover this, along with the renewal and retrofit markets related to existing infrastructure.

Euroconsult consultant, Alexandre Corral, added: "With a recent trend to virtualize ground stations to enable greater flexibility, the report explains how this is especially relevant to the areas of EO and mega-constellations, as it is expected to drive down costs.”

The impact of COVID is highlighted in the report, with the user terminal market being more affected due to the reduction in activity in transport and enterprise. Euroconsult estimates the 2020 market for user terminals is $400 million lower than the 2019 market because of COVID, although this will recover as enterprise increases.

For ground stations, Euroconsult does not anticipate a direct impact on market revenues due to COVID, but did see delays in the equipment supply chain. In the EO market, the ground station segment actually increased.

The report highlights the large market opportunity in the ground segment, along with the continuous innovation to improve performance and cost efficiency. This improvement drives the ongoing adaptation of the ecosystem, with an acceleration in the number of M&A transactions and strategic partnerships to be signed over the next two years.

Euroconsult's Ground Segment Analysis 2021 report is available from the Euroconsult shop