In 1984, Space Insurer Jim Barrett was overjoyed when the 14th Space Shuttle flight retrieved Palapa B2 and Westar 6, two failed communication satellites whose identical anomalies had left them stranded in useless orbits far below their intended geosynchronous target of 35,786 kilometres above the Earth. Both satellites had been launched on the 10th Shuttle mission of Challenger, but each had suffered separate failure of their perigee kick motors shortly after being deployed.

It was a dramatic rescue; the satellites were not designed to be recovered, and although their spin rate had been decreased from fifty to two revolutions per minute, specific hardware had to be developed and used to capture each nine foot tall spacecraft, then manoeuvre them carefully into the Shuttle’s cargo bay. The mission was a complete success and validated both the Shuttle’s capability and the concept of satellite recovery.

Ownership of the satellites had passed to insurers upon payment of $180 million for the satellites’ initial failure. Worse, the insurers were facing an additional substantial loss as they covered the cost of the rescue.

Thanks to the efforts of Shuttle Commander Rick Hauck and his crew on Shuttle Discovery, the insurers recouped around $50 million of their losses because both satellites were successfully returned to Earth, refurbished and re-launched as Palapa B2P and Asiasat 1. Lloyds of London awarded the NASA crew the Silver Medal for Meritorious Service in recognition of their achievement.

This was a major accomplishment and an early example of a commercial satellite being restored after suffering a major anomaly. Rick Hauck remained well known to insurers and upon leaving the Navy in 1990 became CEO of Jim Barrett’s insurance company, International Technology Underwriters.

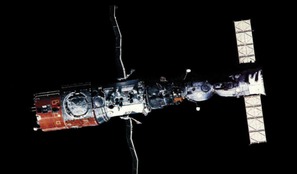

Intelsat 603 rescue

Six years later in 1992, NASA again rescued a stranded satellite in a similar situation. This time insurers insured the rescue mission itself. It took three attempts to capture the spinning Intelsat 603 satellite. Ultimately it required three astronauts to grab the satellite with their own hands, and make history by performing the first three-man spacewalk.

On this occasion the satellite was fitted with a new boost motor whilst still in orbit before being released. The event mobilised the world’s media and is proudly remembered by all involved. It was also a milestone achievement for Intelsat in more than one way. The fix allowed the satellite to reach geosynchronous orbit, but what is less well known is that it operated there for the next twenty years, way beyond its original design life, earning over $800 million in revenue for Intelsat.

Now, more than twenty years later, we are without the Space Shuttle and despite significant advances in robotic satellite servicing technology, we are currently unable to perform any on-orbit servicing. As a result, the only recourse satellite operators have when satellites or launch vehicles encounter issues is to launch a costly replacement.

Repeat launches – if they are feasible at all – take years to schedule and in the interim customers look elsewhere for satellite services. Given the importance of commercial satellites in modern life, the value of these assets and the frequency of anomalies, it behooves satellite operators to join forces with insurers to support the development of satellite servicing technology.

Economic value

We all know that satellites provide essential strategic and economic value. They deliver communications, navigation, weather and imaging services to every corner of the globe. However, among this list of satellite missions, it is the communication satellites that contribute most to our quality of life and to commerce.

Satellite insurance policies are carefully tailored to align with the overall risk management approach of the satellite owner

The insurance market for the commercial space industry is global. Satellite owners, manufacturers, launch services providers, insurance brokers, and underwriters, are all involved in establishing the insurance for any commercial satellite launch. The space insurance industry as a whole produces about $700 million in premiums per year. There are about 25-30 insured launches annually; a typical launch will be insured for $300 million.

Satellite insurance policies are carefully tailored to align with the overall risk management approach of the satellite owner. Insurers combine complex technical understanding with contract analysis, risk evaluation, insurance modelling and claim negotiation. It is a challenging environment with a limited number of players.

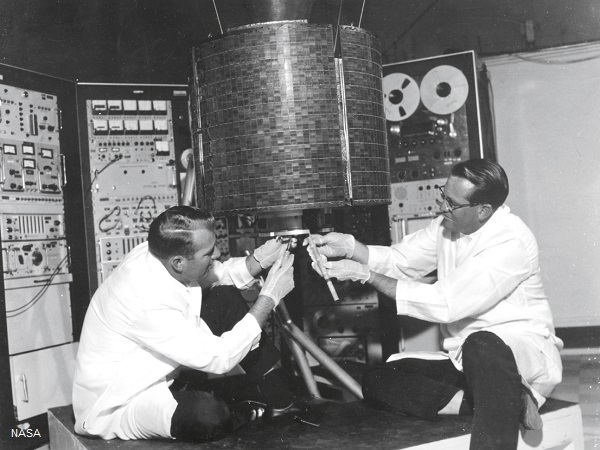

Astronaut Dale A. Gardner, holds up a “For Sale” sign referring to the two satellites, Palapa B-2 and Westar 6 that they retrieved from orbit

Satellite failures occur with a somewhat predictable frequency. Ignoring complete launch failures, during the past five years insurers have paid claims on at least 12 commercial satellites that have been placed into incorrect orbits, have suffered propulsion leaks, or had solar array or antenna deployment issues.

Express AM4, Yamal 402, Express MD2, Telkom 3, Galileo and Orbcomm have all had missions curtailed or abruptly terminated due to injection into the wrong orbit. Significant propulsion system leaks have occurred on Chinasat 6A and Eutelsat W3B. Notable issues during deployments have affected Intelsat New Dawn, Telstar 14R, Intelsat 19 and Amazonas 4A. Some of these satellites were almost certainly missed opportunities for on-orbit servicing.

These failures, all discovered immediately after launch, have cost insurers in excess of $1.5 billion in claims. On-orbit servicing has the potential to mitigate some of these issues, which will almost certainly continue to occur. On-orbit servicing is not a cure-all solution, but if it has the ability to fix even some of these problems it should appeal to satellite owners and insurers alike.

Satellite servicing

The goal for satellite servicing is straightforward. Servicing missions need to be able to refuel, repair, or upgrade satellites on a timely basis after they are launched. This approach will not only benefit satellites suffering failures early in life, but could also extend the life of satellites approaching retirement due to lack of fuel.

On-orbit servicing may one day change the economics of space access

Much like the internet has changed the economics of broadcasting; on-orbit servicing may one day change the economics of space access as it could lead to assembly in space, either of larger structures or of component parts salvaged from retired satellites. It is likely that servicing missions may also be used to remove orbital debris, an issue of growing concern for all insurers and satellite owners, with more than 200 dead satellites in geostationary orbit. Of even greater concern for operators with assets in lower Earth orbits is the additional threat of collision from thousands of launch vehicle spent parts and non-operational satellites.

Various companies and organisations have been trying to develop satellite servicing technology. Early solutions are likely to focus on transporting satellites from incorrect orbits up to geostationary, or extending the lives of satellites running low on fuel.

ViviSat, Effective Space Solutions and Skycorp are three such companies with plans to deploy servicing missions that could assist disabled satellites to reach their intended orbits, keep older satellites in orbit longer and potentially do much more. With the advancement of robotics, in particular medical robotics, technologies that used to be found only in science fiction may soon become a reality in the space industry.

The US Defence Advanced Research Projects Agency has a program called Phoenix, which aims to repair satellites and create new on-orbit assets from pieces of retired satellites. Likewise, NASA’s Robotic Refuelling Mission has already demonstrated blanket and wire cutting, cap and fastener removal and the transfer of fluids on the exterior of the International Space Station. This is a major achievement; in space, weightless propellants move in unexpected ways, and anticipating how to transfer these corrosive and hazardous fluids from one spacecraft to another will be a critical milestone for refuelling missions.

Risks and capabilities

From an insurer’s viewpoint any technology that helps to mitigate the risk of loss and reduce or avoid insurance claims should be encouraged. But demonstration of these technologies will be required for owners and insurers to become comfortable with their capabilities and risks. Both need technical and operational data to assess risk versus reward. On-orbit servicing operations will be by their very nature more complex than typical satellite operations.

The servicing satellite will need to locate, approach and dock with another object in space. In the case of a recovery mission the impaired satellite will need to be placed in a safe orbit whilst waiting for service, and may potentially be operated outside of its originally intended design. This in itself will be challenging given that commercial communication satellites are currently not built with servicing in mind.

Cost-conscious satellite manufacturers with mature satellite designs are naturally reluctant to add features that they expect will never be needed, nor are they incentivised to add cost, weight, risk, liability and schedule to a programme to add such features. In addition, satellite manufacturers are restricted in their ability to share information on the condition of a failed satellite to third parties without the express permission of the satellite owner. This makes it very difficult to assess the feasibility of a rescue or refuelling mission, either from a technical or economic perspective, on a timely basis.

Satellite manufacturers will also weigh the benefits of refuelling or repairing a satellite against a future sales opportunity. Insurers can do their part by encouraging satellite operators to consider standard servicing features such as common connectors, valves, targets and attachment fixtures. If this is accomplished, insurers may need to reconsider underwriting decisions and premium requirements for satellites with such features.

The down-side of on-orbit servicing

Whilst the benefits of on-orbit servicing are clear, and the technology goals attainable, there are other challenges that have so far prevented the industry from becoming established. The most serious issue appears to be the economic feasibility. Clearly, there is a business case for restoring a satellite that experiences a significant issue early in life, but identifying specific opportunities for business planning purposes is impractical. As a result business plans to date have been focused purely on the market for refuelling older satellites, which with additional fuel could continue to operate and generate revenue.

Even for a servicing mission visiting multiple satellites this does not seem to justify the cost of the servicing missions, possibly because satellite operators would rather replace older satellites with newer, more capable technology. Therefore some combination of both on-orbit refuelling and repair of newer satellites, based on statistical probability of occurrence, needs to be simultaneously projected for each servicing mission.

Insurers will need to accept that failure of servicing missions could result in damage to both the satellite being serviced and the servicer. Additional debris and liability could also be created, potentially affecting other satellites. However, as servicing missions become more routine, insurers will accept that insuring against failure from a servicing mission is in theory no different from insuring any other satellite mission.

Insurers will have a greater role to play, as they are typically obligated to pay claims promptly upon agreement that a loss has occurred. In these situations, as with Palapa B2 and Westar 6, it may be that the insurance community has the rights to the satellite or its income in the event that it is returned to use by a stuck antenna or solar array being released, or the stranded satellite is towed to geosynchronous orbit months or years after launch. It is likely that insurers would seek to sell the satellite back to the owner or another third party before it is serviced. However, international law makes the responsibility and liability for space objects uncertain, and without such agreement in place the number of insurers willing to participate may be limited, ultimately resulting in the satellite being intentionally de-orbited.

NASA has serviced the Hubble Space Telescope five times during the space telescope’s 25-year lifetime

The salvage clauses in most space insurance policies do not predict a scenario in which a servicing mission is viable. Questions such as which insurers could approve a servicing mission, who should pay, who should benefit, and who should bear the risk of failure and liability will need to be addressed. With up to thirty insurers participating on the insurance for one satellite it is hard to envisage all insurers being in agreement.

This insurer believes that the benefits of on-orbit servicing are too important to ignore and despite the challenges, a solution can be found. Servicing has the potential to repair malfunctioning satellites, clear retired satellites and debris from geosynchronous orbit, and may pave the way to industry growth with the assembly of larger structures in space. These missions are just around the corner and insurers and satellite owners stand to be the beneficiaries of improved reliability and industry expansion.