For decades now, the development and exploitation of satellite missions has been led by major multi-national companies backed up by governmental and institutional organisations mainly focused on security or the environment. As a result, just a handful of wealthy commercial organisations such as those in energy or insurance sectors could afford access to derived products or information.

With the arrival of applications such as Google Maps in 2005 or handheld devices like the iPhone in 2007, the exploitation of space assets for imagery, mobile telecommunications or navigations has been opened up to users that had previously not considered them valuable to their business.

A number of companies have noticed this trend and are developing innovative business models to capitalise on it. This new technology and market trend is called “NewSpace”; it describes the new generation of space development, notably commercial, which are disrupting the dynamic of the space sector.

The NewSpace trend is a transition of the space sector which has been enabled by the Commoditisation of Space Technology. This term refers to the stage at which the technology is commercially available in off-the-shelf form, and/or when the knowledge or parts required to build the technology are freely available.

Commoditisation of space technology

The interesting thing about the commoditisation of space technology is that it affords all players a new foundation of common-denominator technology to build upon. Innovation can then move up to the next level of abstraction. Almost nobody builds their own satellite standard anymore – it doesn’t make sense to re-invent the wheel when there are several incredibly powerful, commoditised open source options. Everybody just innovates on top. The two most relevant satellite standards are the well-established CubeSat and the emerging PocketQube.

The first one is a 10cm cube weighting 1.33kg. These specifications were defined in 1999 by California Polytechnic State University and Stanford University. Assembled in units containing 2, 3, 6, 12 etc individual cubes, CubeSats offer much greater capabilities and flexibility, which positions them now as ideal for commercial exploitation in opposition to their original technology demonstration or scientific aims. Although the smallest CubeSats still have limited capabilities, they represent a unique opportunity in term of learning curves to get quick access to space.

Indeed, since CubeSat are all 10x10cm regardless of length, they can all be launched and deployed as secondary payloads using a common deployment system called a Poly-PicoSatellite Orbital Deployer (P-POD).

These opportunities have been seized upon by industrial organisations such as Clyde Space who has been providing CubeSat components for almost half of the CubeSat missions built during the last decade; or launch service providers such as NanoRacks1 who have launched more than 200 CubeSats from the International Space Station.

The second standard, PocketQube, is a 5 cm cube with a mass of no more than 180 grams. Although its commercial exploitation is still very limited, it represents a fantastic tool for education. The Satellite Applications Catapult is currently using it as a framework to educate students on the new opportunities space is offering2 by making them build a PocketQube satellite over a weekend.

The commoditisation of space technology is also happening in the launchers market. Who hasn’t heard the recent attempt from SpaceX (Space Exploration Technologies Corporation), a commercial launch provider created by Paypal’s founder Elon Musk, to land their heavy Falcon 9 first stage on a custom-build ocean platform3? By re-using the first stage, SpaceX wants to break the $1,000 per pound launch cost barrier; in comparison to around $5,000 per pound of payload for an Ariane 5.

‘Instead of failure can’t be an option, fail fast and often’

Another example is the US-based air-launch company for Micro/Nano-Satellites Generation Orbit. It has set the ambition to operate their fast, flexible and dedicated launch service by 2016 in response to the fast growing Nano/Micro-Satellite market. The notable aspects of Generation Orbit is not so much the price per pound but the response to launch delays that small secondary payloads are experiencing. Indeed, the critical aspects of exploiting the commoditisation of space technology for developing missions in a few months is to have quick access to space to hit the market first. Currently, Nano/Micro-Satellites do not have viable and sustainable dedicated launch services. They are currently offered only secondary payloads options for launch services; which makes them dependant on the primary payload’s progress, or lack of.

Failure not to be feared

At the very popular Small Sat Conference organised last summer in Logan, UT, USA, Steve Jurvetson (The “J” from the venture capital firm DFJ4) delivered an inspirational keynote. It followed the recent success of companies backed by DFJ Venture (namely Planet Labs and SpaceX) which could be summarised in one sentence: “Instead of failure can’t be an option, fail fast and often”.

And this is exactly what Planet Labs has been doing for the last couple of years. Planet Labs is a well-known NewSpace start-up, based in Silicon Valley that has launched an incredible number of 73 Doves (3 unit CubeSats) since April 20135. But the most remarkable aspects of Planet Labs is that they are applying the so-called Lean Startup Concept to satellite development.

Basically, what Planet Labs did since its creation was to build a first Minimum Viable Product (a Dove) with off-the-shelf technology, launch it, learn from its failure and improve the next one in the same way a software company would do with new releases. They have now been doing this for almost two years at an unprecedented pace: new build every six weeks, more than a dozen flight models.

Satellite Applications Catapult PocketQube CAD model showing the easy access to on-board computer interface

This is pushing the concept of customer and product development to its limit in the difficult space environment. The result is that their image products are more and more mature and always gaining in commercial value. Planet Labs is now closing a planned $70m Series C round in addition to a debt facility of $25m6. We should see pretty soon if they will succeed in their exit via an initial public offering or by being bought out by a larger player.

NewSpace startups investment

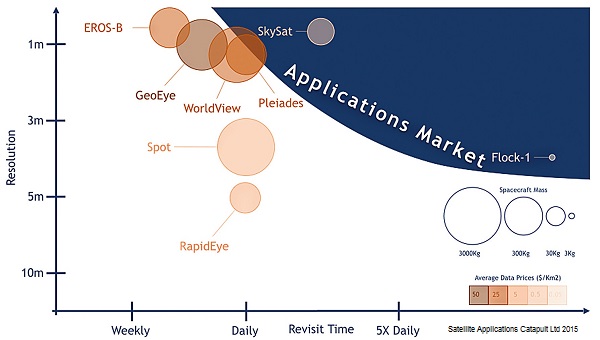

This last cashing-out criteria is very important for NewSpace entrepreneurs and their investors. While space starts to be more interesting for private investment (Angels or Venture Capital), the creation of new markets and successful exit strategies still need to be proven. Although this last critical aspect has recently been demonstrated by SkyBox Imaging, the creation of new markets is still not obvious.

Resolution: The level of details of an image needs to be at the economical scale. Revisit: The frequency of imaging offered should be more often than every hour to monitor changes occurring on a daily basis. Price: Pixels with no-minimum orders should be made available at such a low price that only the resulting information which will be extracted from would have a value

Resolution: The level of details of an image needs to be at the economical scale. Revisit: The frequency of imaging offered should be more often than every hour to monitor changes occurring on a daily basis. Price: Pixels with no-minimum orders should be made available at such a low price that only the resulting information which will be extracted from would have a value

The paradigm shift between multi-national space organisations focusing mainly on upstream markets (satellite manufacture) towards NewSpace start-ups focusing on downstream markets (exploitation of space assets for big data or business intelligence applications) is mainly enabled by the fast development of the companies and technologies which enable a return on investment within 3 to 5 years. The greatest example demonstrating private venture investment into a NewSpace start-up is Skybox Imaging.

Skybox Imaging7 was founded in early 2009 and quickly raised a $3m Series A of private investment from two Venture Capital firms. They used this to demonstrate that they could design a satellite which would achieve HD video and sub-metre image resolution for a fraction of the price of existing space assets from larger organisations. One year later, following the successful achievement of the detailed design review, they went for a $18m Series B to build the first 2 technology demonstration satellites (SkySat-1 & 2).

Finally, in May 2012, before launching their first satellite SkySat-1 on 21 November 2013, they raised a $70m Series C to scale up their constellation. On the 10th June 2014, one month before launching their second satellite SkySat-2, Skybox Imaging announced publicly their acquisition from Google for $500m8.

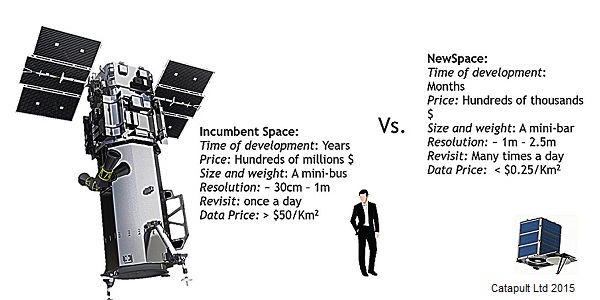

Simplified representation of spacecraft characteristics from Incumbent and NewSpace organisations

Simplified representation of spacecraft characteristics from Incumbent and NewSpace organisations

This successful liquidity event is remarkable for two main reasons: the first one because it is the very first high profile successful exit for a NewSpace start-up (5 years, $91m investment, $500m cash-out), the second one because this acquisition is from a non-space industry: Google. This demonstrates that space is no longer a niche sector. It is a high-growth opportunity in the big data and business intelligence sector.

Looking at the evolution of space companies, we can clearly differentiate Incumbent Companies and NewSpace Companies. Incumbent companies are mainly large multi-national organisations which have been backed-up during decades by governmental and institutional customers looking at delivering very high-resolution imagery for wealthy industrial customers. NewSpace organisations instead are focusing on an applications market that will consume data and cut back the satellite manufacturer as a means to deliver business intelligence and big data related services.

Responsible exploitation

As depicted in the previous sections, space is currently experiencing more than a transition; it is clearly a disruption. The commoditisation of space technology, the low cost access to space, the innovative business model and availability of private investment are shifting the paradigm of upstream technology to downstream applications markets. As a result, by being more affordable, more and more organisations will move into this fast growing market very soon.

Just recently, two major commercial organisations have announced their intention to invest in huge constellations of small satellites (4,000 satellites for Space X and 650 for Virgin Galactic9) to broadcast the Internet to the world. This re-ignites the debate around debris and the exploitation of space. Indeed, although space is infinite, only very few orbital planes are exploitable for remote sensing, telecommunication or navigation. The challenge that we’re facing now with space is how to operate responsibly in order to maximise its sustainable exploitation? In other words, how can we mitigate the risk of pollution in space.

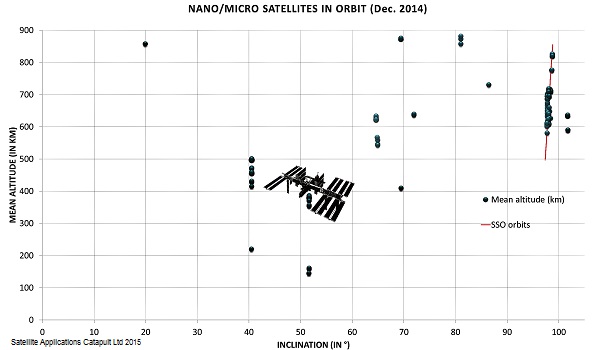

Due to their small size Nano/Micro-Satellites are difficult to track from the ground, carry no-propulsion device for collision avoidance manoeuvres and are increasing their numbers in space. This means that they may be perceived as a threat for larger satellites. In reality, this is completely the opposite and such a perceived risk can even be mitigated by adopting a more responsible approach.

The in-orbit collision risk between two Nano/Micro-Satellites is almost nil due to their size and their composition. Collisions with larger satellites could be avoided by making it mandatory that every Nano/Micro-Satellite be equipped with a tracking device, such as the retro-reflector proposed by Dr. Stuart Eves during the last Re-Inventing Space Conference in London. This would make them trackable from the ground and offer larger satellites the opportunity to undertake collision avoidance manoeuvres.

CubeSat is the most common standard of Nano/ Micro-Satellites enabling low-cost access to space

The other risks are the pollution of space orbits and ground damage during re-entry. Again, although the numbers of Nano/Micro-Satellites to be launched will be much more than larger satellites, the orbits they are operating in make them disposable within a few years. High fidelity mathematical models, such as run by the University of Strathclyde10 demonstrate that a Nano/Micro-Satellite in-orbit lifetime will comply with the 25 years guideline, and can even be accelerated with de-orbit device such as solar sails11. Also, the Nano/Micro-Satellite will never cause any damage on the ground, as it will disintegrate in the atmosphere.

Representation of all CubeSat in orbit to date according to their altitude and inclination

Representation of all CubeSat in orbit to date according to their altitude and inclination

Current regulatory regimes, defined decades ago for large satellites, would need to be revised in order to offer alternatives for Nano/Micro-Satellites operators adopting a responsible approach to maximise the exploitation opportunities rather than blocking their expansion. This responsible approach has already been implemented by a few countries who are willing to take the liability on behalf of their Nano/Micro-Satellite operators in return of the development of high growth commercial opportunities. Countries unwilling to adopt such a position will run the risk to the NewSpace Entrepreneurs flying away to succeed in the more forward-looking countries.

The in-orbit collision risk between two Nano/Micro-Satellites is almost nil due to their size and their composition

The beauty of the NewSpace trend is that we’ll not have to wait decades before being the witness of the first successes or failures, it will be a matter of three to five years before seeing if great visionary NewSpace start-up such as Planet Labs, Skybox Imaging, Generation Orbit or NewSpace Entrepreneurs such as Elon Musk (Space X), Peter Platzer (Spire) or Craig Clark (Clyde Space) have managed to open up a NewSpace Age.

References

1 http://nanoracks.com/category/missions/

2 https://sa.catapult.org.uk/-/catapult-runs-its-first-pocketqube-event-in-poland

3 https://vine.co/v/OjqeYWWpVWK

4 http://dfj.com/content/steve-jurvetson

5 https://www.planet.com/pulse/planet-labs-raises-series-c-funding-primed-for-growth/

6 http://theleanstartup.com/

7 https://www.planet.com/gallery/

8 https://www.crunchbase.com/organization/skybox-imaging/funding-rounds

9 http://spacenews.com/spacex-opening-seattle-plant-to-build-4000-broadband-satellites/

10 http://www.strath.ac.uk/stardust/

11 http://www.clyde-space.com/cubesat_shop/de-orbit_devices