Like the app revolution enabled by the iPhone, data from space can enable a revolution of applications to help us build a sustainable future, to understand our planet and make better business decisions. The author argues that the ‘iPhone moment’ for the Earth observation industry is ‘now’, enabled by cheaper launches and more efficient satellite manufacturing processes. The question is how to capitalise on it.

Earth observation is expected to grow into a multi-billion dollar industry thanks to the numerous applications of satellite data across business niches, or ‘verticals’, including agriculture, energy, infrastructure, insurance and financial services, along with the biggest customer of satellite imagery, the defence sector.

Advancements in satellite miniaturisation and a reduction in launch costs have meant that different types of payloads and sensors can now be developed and flight-tested faster and cheaper than ever before. This has enhanced our ability to monitor the Earth and collect more different types of data than before. These range from monitoring radio frequency signals to identify illegal fishing (Hawkeye360, Kleos, Unseenlabs) to using radio occultation signals from navigation satellites to better understand our weather (Spire, GeoOptics).

We can also keep track of greenhouse gas emissions (GHGSat, Bluefield, MethaneSat), keep an eye on the energy efficiency of the buildings in which we live and work (SatelliteVu), monitor the spread of wildfires (ConstellR, OroraTech) and enhance predictions of crop yields and plant health (ScanWorld).

Data sources

Several hundred satellites from many different manufacturers are already up in space taking pictures of the planet several times a day, while radar payloads enable us to gather data even during darkness and through cloud cover. Indeed, real-time monitoring of Earth from space could be possible in the near future.

Moreover, data generated in space will soon be processed in space thanks to the advancements expected in edge computing and in-orbit processing in the next decade. This could mean that only the analytics and insights need be downlinked, instead of the petabytes of data being transmitted today. A bitter pill that is sometimes hard for the space industry to swallow is that Earth observation (EO) is just another source of data - similar to economic data, financial data, social media data and so on. The only difference is that the data happens to be gathered in space.

However, for the vast majority of the applications mentioned above, the value is not in the consumption of EO data. It is in the information leveraged from satellites and combined with other sources of data in order to create a data-driven product of value to the end user. So gathering the data from satellites is only a small part of the challenge.

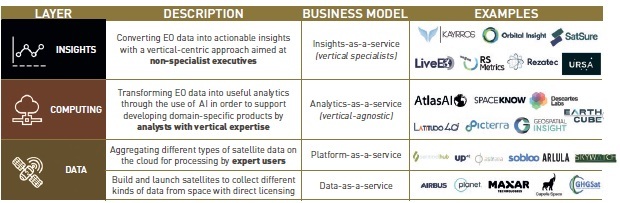

EO industry layers

Earth observation is expected to grow into a multi-billion dollar industry thanks to the numerous applications of satellite data across business niches, or ‘verticals’

In reality, the Earth observation industry can be classified into three layers: the Data layer, the Computing layer and the Insights layer, each with its own business models and target audience.

The data layer is the part of the EO industry concerned with the generation and collection of data by satellites and is the layer that attracts the most attention from both inside and outside the space industry. But the data layer is very fragmented, with each company trying to acquire a part of the market based on the type of the data they collect - optical, infrared, hyperspectral, radar, automatic identification system and so on. Moreover, most companies are increasingly becoming more and more vertically integrated and thus aim to operate in more than just the data layer.

The fragmentation of data means that there is a niche in the market for aggregators and digital platform operators, who provide aggregated, pre-processed and ready-to-use data with cloud infrastructure, essentially aiming for a platform-as-a-service business model.

It is noteworthy that the corresponding audience for both components of the data layer are geospatial developers and remote sensing experts, which is certainly a sizeable portion of the market, but not the majority. An example would be a geospatial developer tasking a commercial satellite to capture imagery over an area of interest, receiving the imagery and performing image processing and further analysis in the cloud.

The computing layer facilitates the uptake of EO data by providing ready-to-integrate analytics, leveraging on advancements in AI and computer vision, and providing results in a vertical fashion (cars, trees, buildings, planes, roads, ships, containers and so on). This is aimed at non-geospatial, yet technical users who actively integrate satellite data and derived analytics on-the-fly to build specific products for internal use within companies across different verticals.

However, without further analysis and fusion with other sources of data, the analytics derived from satellite data does not fulfil its potential value. An example would be a data scientist with limited geospatial and remote sensing skills who integrates the analytics from satellite data, such as the number of buildings in a city, for developing property insurance models.

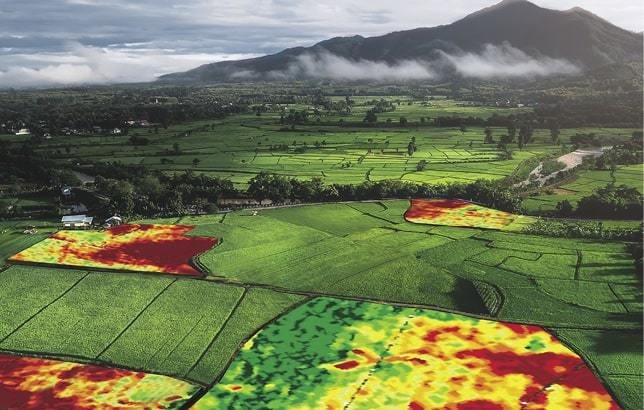

Precision agriculture enabled by data from satellites is allowing farmers to access near-live imagery of fields and crop damage.

Precision agriculture enabled by data from satellites is allowing farmers to access near-live imagery of fields and crop damage.

The Insights layer is where all the possible value from EO data is realised, thanks to applications built on top of satellite data and combined with other data sources. The audience for products in the Insights layer are users from specific industry verticals who would directly use insights provided by satellite imagery to support their decision-making processes.

In some cases, this audience does not know how the insights are derived, as the focus is more on the consequences of using the insights for their business decisions. An example would be an executive user from a financial services company analysing the crop yield prediction values for a farm in order to finalise the risk assessment of his investment portfolio.

Building unicorns

The Earth observation industry is going through a golden phase with the deployment of some sensational sensors with potential for applications in every industry and geography. However, this also means that the technology has countless solutions for various problems; in other words, the technology is trying to solve too many problems at the same time. In reality, it seems like most of the developments in Earth observation are great solutions still looking for a problem! How then could successful companies - or in start-up terminology ‘unicorns’ - be created?

It probably begins with the problem and defining what specific problem, within an industry, is being solved using EO data. This is rather different from the current value proposition for most EO solutions, which is ‘EO can solve lots of problems in different industries’. It may be that EO data can solve various adjacent problems within industries, but the challenge lies in the positioning of the product among the three layers (Data, Platform and Insights), based on the industry targeted and the type of users.

Graphic representation of EO satellites.

Graphic representation of EO satellites.

The target audience in some industries can be catered for by the Data layer, whereas others may find only the Insights layer useful. Therefore, finding the problem and the go-to-market distribution model go hand-in-hand.

Going in-depth into a vertical market and asking if the product, powered by EO data, can actually ‘get the job done’ for a customer, helps one to understand the trends in that specific vertical market. More often than not, we find that EO data is great for building lots of applications in various sectors, but some of them might be in areas where there is just not enough addressable market. Another significant aspect that is often overlooked is the need for domain expertise within the EO sector.

Sometimes, finding the right problem and identifying the right distribution model can only be done by gaining expertise in the vertical of interest. Therefore, it is necessary to step out of the ‘EO bubble’ as far as possible in order to appreciate the customer’s perspective. Finally, it might be the case that EO data is not a significant part of the solution for a particular problem, and perhaps not as significant as the early assumptions suggested. Hence, it is necessary to focus on the situations where EO data is a ‘must-have’ rather than a ‘nice-to-have.’

Once we have established that EO data is a must-have, another crucial element to be established is whether there is a case to be made for generating more EO data (i.e. to take on the capital-intensive efforts of building satellites and launching them). The decisions will depend on factors such as innovations leading to reductions in the price of EO data, geopolitical needs or new technological advancement leading to the availability of a new type of data.

Small satellite constellations are on the rise, which will produce more data, but it is plausible that the focus will shift from data generation to data exploitation in the next few years, which should help the valuations of unicorn-level companies, given the scalability of software products and their unit economics.

Artist’s concept of NASA’s TROPICS mission using a constellation of 12 CubeSats flying in formation to study hurricanes.

Artist’s concept of NASA’s TROPICS mission using a constellation of 12 CubeSats flying in formation to study hurricanes.

Hype bubble

Our duty lies in evangelising about the applications of EO data to those who live outside the ‘space bubble’

There are plenty of innovations occurring in the Earth observation sector - both in upstream and downstream domains - from advancements in sensors and small satellites to developments in cloud computing and machine learning. All this points to the fact that there is a big hype developing within the EO sector, which in reality is still a very small part of the overall space industry.

Uber, Instacart and Tinder are not considered space-tech companies but still rely heavily on space technologies. I believe the unicorns of the next decade will rely on some sort of EO data based on some of the innovations mentioned above. Whether the EO sector promises to live up to its expectations of becoming a multi-billion dollar market and justifies the hype through rapid adoption akin to GPS is something that is yet to be shown. EO technology is still not as democratised as it should be and few among the general public understand its use in the context of the larger ‘big data’ economy.

As an example, Apple heavily evangelised about the Mac to developers around the world; it was the first computer to have a graphical user interface, as opposed to command-based computers which were the norm at the time. To kick-start the app ecosystem, Apple developed the Software Development Kit (SDK), making it easy for developers to write code and publish it on their App Store. The rest is history.

The dreamer inside me believes that Earth observation data will definitely unlock multiple, multi-billion dollar markets across verticals, traversing throughout the value chain with benefits becoming harder and harder to quantify - similar to how data from navigation satellites have become the core of the app economy.

As advocates of the space industry and proponents of the impact of space technologies on Earth, our duty lies in evangelising about the applications of EO data to those who live outside the ‘space bubble’. It is, I believe, our responsibility to not allow this bubble to burst.

About the author

Aravind Ravichandran is the founder of TerraWatch Space, an independent space industry consultancy. With over eight years of experience across different sectors, Aravind brings a unique multidisciplinary perspective to the space industry. Prior to this, he was a Senior Strategy Consultant at PwC Space Practice, involved in performing strategic assignments for companies in the Earth observation sector as well as for the European Commission and the European Space Agency. As an active thought leader and speaker, Aravind writes a monthly newsletter and hosts a podcast focusing on decoding space technologies and their impact on Earth.