For the uninitiated, space insurance is normally purchased to cover the launch (from intentional ignition of the launch vehicle) and a short period, usually one year, in orbit. After this period, the in-orbit portion of the insurance can be renewed on an annual basis much like automobile insurance. The insured value of the spacecraft normally covers the cost of its construction, the cost of a launch (or replacement launch), and even the cost of the insurance itself (the ‘premium’).

Insurance for commercial satellites is still common for certain classes of spacecraft, for example communications satellites in geostationary orbit (GEO) or commercial Earth observation satellites in sun-synchronous orbit (SSO). However, it is less common where there is a lot of in-orbit redundancy: for example, while groups of spacecraft planned to become part of a commercial constellation might be insured for launch, their in-orbit lifetimes might not be covered.

Spacecraft insurance losses related to the orbit type are not covered in this article, because most major insured spacecraft are in GEO. Low Earth orbit (LEO) constellation operators sometimes insure the launches of their spacecraft, but not for in-orbit risks and such is the number of their spacecraft that they normally have enough redundancy in orbit to guarantee their service without needing in-orbit insurance.

Artist’s concept of the Intelsat 29e satellite with antennas and solar panels unfurled. Explosive failure in April 2019 resulted in the total loss of the spacecraft.

Artist’s concept of the Intelsat 29e satellite with antennas and solar panels unfurled. Explosive failure in April 2019 resulted in the total loss of the spacecraft.

Orbital launch dataset

Typically, a spacecraft suffers anomalies in the first year of life before dropping to a low failure rate

Originally developed by Airclaims, an aviation loss adjuster and information firm, Seradata is a commercially available subscription database published by Slingshot Aerospace. It records the result of every orbital launch attempt for every spacecraft launched and, whenever possible, also registers spacecraft anomalies and their causes.

While it sometimes takes time to do so, the Seradata team has usually been able to gather details of serious anomolies and failures which cause space insurance losses. Although some small spacecraft can be insured without the knowledge of the general insurance market and some space risks in certain nations (e.g. China) may be placed in a local market, the dataset is considered sufficiently complete to allow conclusions on general reliability trends.

Calculating insurance loss

A spacecraft may lose some of its mission capacity when an anomaly occurs. For example, if a spacecraft lost two out of four equivalent communications transponders (or science instruments), this would be regarded as a 50 percent loss of capacity and thus a 50 percent loss of capability. Sometimes, both a mission capacity loss and a lifetime loss can occur, as shown in the following calculation.

If an anomaly resulted in the loss of a quarter (0.25) of an individual spacecraft’s mission capacity and half (0.5) of its design lifetime, this would be accounted for as follows:

Capability Lost = 1 – [(remaining life relative to initial design life) x (remaining capacity)]

so

Capability Lost = 1 – [(1-design life lost) x (1-capacity lost)].

Thus, for our example, we get:

Capability Lost = 1 – [(1-0.5) x (1-0.25)]

= 1 – [0.5 x 0.75]

= 0.625 (i.e. a 62.5 percent loss of capability).

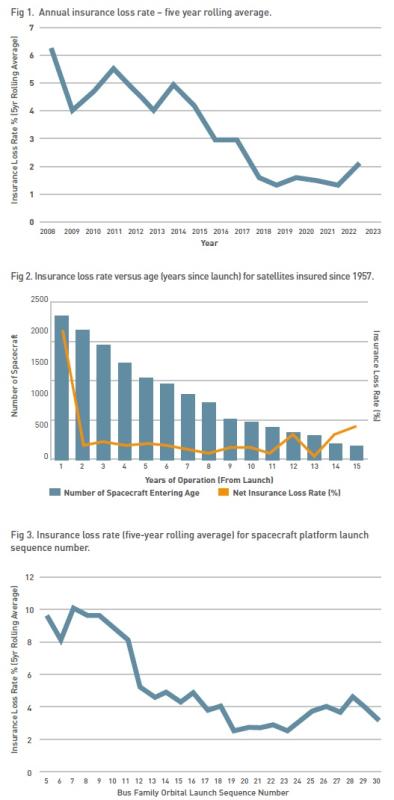

The trend in the annual insurance loss rate fell until 2018, then flattened out before rising again

Although most satellite insurance is more complicated than this and policy wordings include more complex loss formulae, insurers usually calculate insurance losses using a similar procedure.

One significant difference is that insurance losses follow the capability loss relative to the insured value at the time of the loss, rather than for the whole mission. For example, a spacecraft can have a series of insurance policies over its lifetime – and owners may make several claims of up to 100 percent of the insured value. But, of course, a spacecraft cannot lose more than 100 percent of its capability, so insurers agree on the insured value of the spacecraft at a given point in time, usually using a depreciation formula.

Thus, if half the life span or capacity is lost, this would normally result in a 50 percent payout relative to the insured value of the spacecraft at the time of loss. One exception to this rule is the case where an agreed figure (normally 75 percent) is exceeded, when a so-called Constructive Total Loss (CTL) will be declared, resulting in a full payout.

Failure rates and causes

Typically, a spacecraft suffers anomalies in the first year of life before dropping to a low failure rate. By analysing the spacecraft-related launch failures and in-orbit anomalies in the first year, we can measure trends in both the failure rates and the causes. It is important to note that in-orbit anomalies may be related either to the payload (communications transponders, imaging cameras, etc) or to the platform (support subsystems, such as power, propulsion and so on).

As can be seen in Figure 1, the trend in the annual insurance loss rate fell until 2018, then flattened out before starting to rise again. Whether this new trend will continue remains to be seen. In fact, it remains unclear exactly why this happened; it may be related to certain new technologies being more susceptible to total losses, but this needs further investigation.

Launch failures due to the spacecraft are not as common as launch vehicle-related failures

Figure 2 illustrates that spacecraft reliability follows a typical ‘bathtub’ curve for modern electro-mechanical systems, that is a high loss rate in the early years before settling to a low rate and then rising again towards the end-of-life. However, most satellites are retired (due to propellant depletion, as planned) before this point. Although most insurance loss events happen either at launch or during the first year of a spacecraft’s life, space weather events can complicate this trend.

As shown in Figure 3, by measuring the insurance loss rate relative to the platform-family launch sequence number, it appears that the former falls until about sequence number 14, when it stabilises at around the 3-4 percent mark. However, it never achieves a ‘nirvana’ stage of near-zero failure rate as happens with launch vehicles. This may be because platforms are very often modified so that later models may have significant differences to those earlier in the sequence.

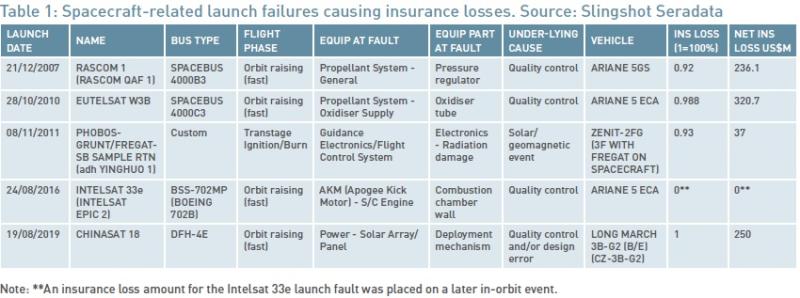

Spacecraft-related launch failures causing insurance losses. Source: Slingshot Seradata

Spacecraft-related launch failures causing insurance losses. Source: Slingshot Seradata

Cause of insurance losses

For every anomaly and launch failure the underlying cause, occurrence phase of flight, and equipment-at-fault has been noted. Launch failures due to the spacecraft are not as common as launch vehicle-related failures and, during the 2004-2023 period, only five spacecraft failures caused an insurance loss. Three of these (60 percent) were quality control-related (Table 1).

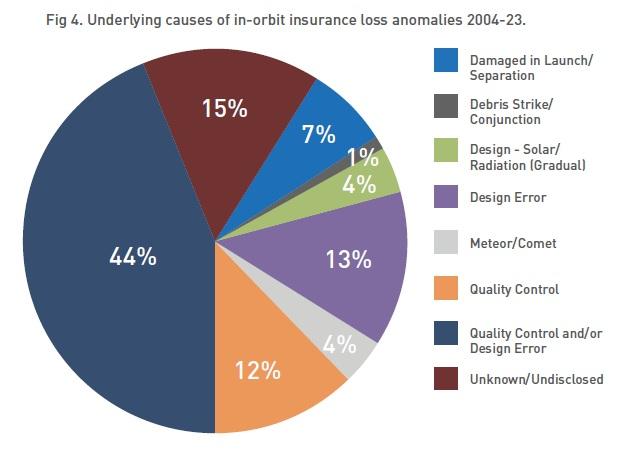

While it is sometimes difficult to pinpoint the underlying cause of in-orbit (post-launch) anomalies, such as quality control or design, many possible explanations can be ruled out, often leaving these as an indivisible pair. Figure 4 shows that these account for 44 percent of in-orbit insurance loss anomalies during the period 2004-23. Where the underlying cause is more certain, design error accounts for 13 percent of anomalies, with quality control at 12 percent.

Sometimes, an anomaly is the consequence of damage incurred during the launch of the spacecraft and this accounts for seven percent of anomalies. The original launch event might have had a quality control issue even if the later anomaly has ‘damaged in launch/separation’ listed as its underlying cause. For example, a quality control issue (with some measure of design error) was responsible for the accidental pressure differential damage to solar arrays on three spacecraft; however, the actual insurance loss was registered to the anomaly after the launch.

Surprisingly, major solar or geomagnetic storm activity did not directly account for any insurance loss anomalies as the underlying cause. This can be taken as a tribute to modern spacecraft design, which includes mitigating measures to counter this risk (e.g. the use of Faraday cages and radiation resistant hardware).

Sometimes, an anomaly is the consequence of damage incurred to a spacecraft during its launch and these account for seven percent of anomalies

That said, there were some cases where solar and geomagnetic activity contributed to an anomaly, even if it was not the main cause. A well-known (non-insured) example was the Intelsat 29e (IS-29e) spacecraft explosive failure in April 2019, which was due to a wiring harness design/location issue (where the harness was located outside of the Faraday cage, near a propellant line). However, it was a solar-induced electrostatic discharge (ESD) to the harness that caused the explosion. More recently, its sister spacecraft, Intelsat 33e, suffered a similar explosion in GEO and it would not be surprising if the same design issue/ESD event combination was the cause.

The first satellite mission launched from the UK failed due to a dislodged fuel filter. Virgin Orbit’s modified jumbo jet, ‘Cosmic Girl’ took off from Newquay, Cornwall on 9 January 2023, releasing the LauncherOne rocket over the Atlantic Ocean. The problem with the filter caused the second stage engine to shut down prematurely and both it and the satellite payload landed in the Ocean, north of the Canary IslandsTable

The first satellite mission launched from the UK failed due to a dislodged fuel filter. Virgin Orbit’s modified jumbo jet, ‘Cosmic Girl’ took off from Newquay, Cornwall on 9 January 2023, releasing the LauncherOne rocket over the Atlantic Ocean. The problem with the filter caused the second stage engine to shut down prematurely and both it and the satellite payload landed in the Ocean, north of the Canary IslandsTable

Meanwhile, anomalies of the slower solar degradation-type, usually affecting solar arrays, account for four percent of failures, according to Figure 4, and debris strikes appear to be a low insurance risk (only one percent) for now at least. This is partly because most insured spacecraft are in GEO rather than in LEO orbit where a greater conjunction risk exists, and where meteor strikes are apparently a significant cause of anomalies. Some within the insurance industry believe that nation states and organisations may be disguising the true nature of on-orbit anomalies by attributing them to meteor strikes rather than reporting hardware failure as the cause.

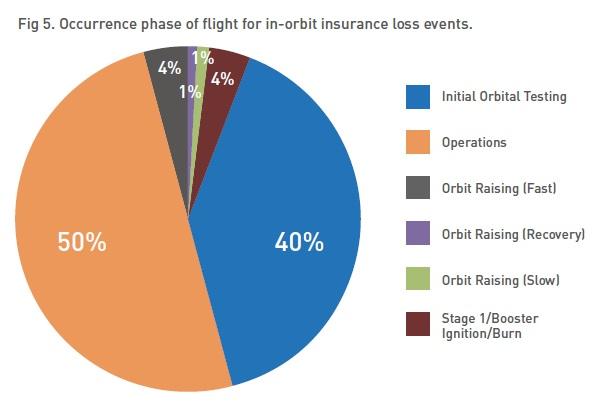

As might be expected, according to Figure 5, spacecraft-related launch failures occur mainly in the orbit raising phase (80 percent). However, excluding the launch and orbit raising phases, most of the insurance loss anomaly events occur in the operations phase (50 percent) or the initial orbital testing phase (40 percent).

Surprisingly though, some ‘launch failures’ occur during the orbit raising phase months after launch. This is because of the increasingly common slow climb to operational orbit using efficient, but low thrust, electric propulsion.

Debris strikes appear to be a low insurance risk (only one percent) for now at least

So, a spacecraft could have both a launch failure event and a subsequent anomaly related to the launch, though only one of these will have the capability and the insurance loss counted on it. For example, a later anomaly may have been caused by damage incurred during a launch, or it might even have been the cause of the ‘launch failure’ in that it happened during the orbit raising/positioning phase. Depending on the policy, insurers will consider the nature of the loss and determine the most appropriate date of loss to be applied.

For spacecraft-related launch failures, propellant systems and apogee kick motors are the main cause of failure (Table 1), accounting for three out of five events (60 percent).

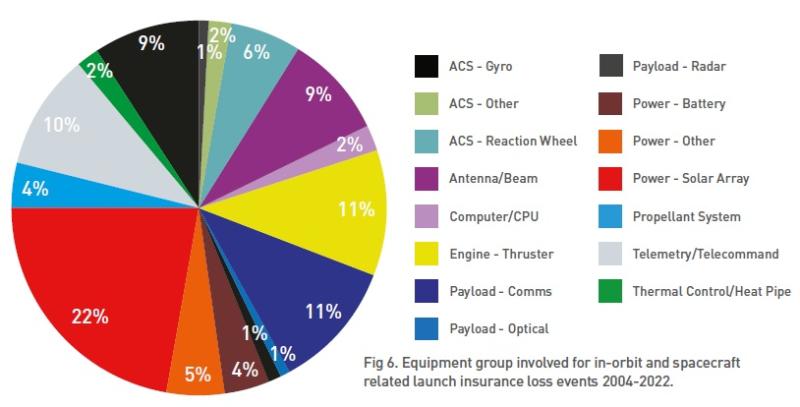

Figure 6 shows an interesting diversity in the causes of insurance loss anomalies for spacecraft launched in the 2004-23 period. As a general group, the power subsystem was the largest cause of these at 31 percent (comprised of 22 percent solar arrays, five percent other power systems, four percent batteries). Interestingly, of the solar-related insurance loss events (18 in total), one third involved a solar array drive mechanism or, specifically, its bearing.

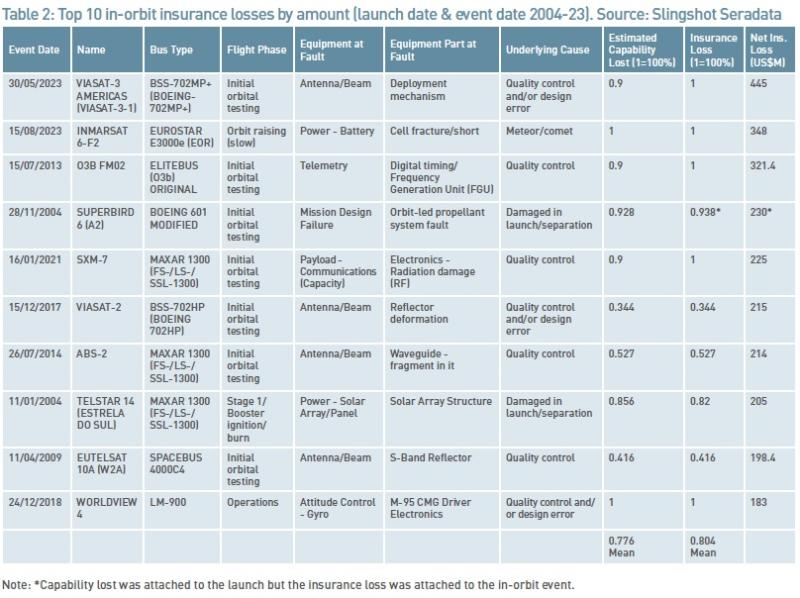

Other subsystems may cause fewer insurance loss claims, but they can be more important in terms of their payout value. For example, of the top 10 in-orbit insurance losses by value during the period 2004-23 (Table 2), four were related to antennas or their beams.

Is the insurance loss percentage a fair reflection of capability loss? Direct comparisons are difficult to make, because spacecraft have multiple insurance policies and some losses are declared as CTLs, but the average (mean) capability loss is 0.777 (77.7 percent), which is close to the insurance loss average of 0.804 (80.4 percent).

In September 2023, a Rocket Lab Electron rocket suffered an anomaly 2.5 minutes into flight, resulting in the loss of a Capella Space Earth-observing satellite. Investigations concluded that the cause of the anomaly was a highly complex set of conditions that are extremely difficult to replicate in testing.

In September 2023, a Rocket Lab Electron rocket suffered an anomaly 2.5 minutes into flight, resulting in the loss of a Capella Space Earth-observing satellite. Investigations concluded that the cause of the anomaly was a highly complex set of conditions that are extremely difficult to replicate in testing.

Future trends

It is tempting to look at trends of past failures and failure rates and think that these will continue, but it is important to be wary in extrapolating trends from past data

It is tempting to look at trends of past failures and failure rates and think that these will continue, but it is important to be wary in extrapolating trends from past data.

Anecdotally, following a spate of failures of one type of equipment/subsystem, underwriters in the space insurance market started to hire experts on that type, only to find that a year or so later, a completely different subsystem was the main cause of major insurance claims.

That said, we can identify some recent patterns. Power remains crucial to a spacecraft’s operation, and solar array deployment and operation is a key area on which spacecraft reliability engineers should concentrate their efforts. Indeed, the power subsystem may grow in importance as more satellites come to rely on electric propulsion for orbit raising.

Meanwhile, antennas and beams already cause 40 percent of high-value, sometimes extremely large, losses and, as deployment systems become more complicated, this seems likely to increase. Spacecraft-related launch failures causing insurance losses are much rarer than launch vehicle-related launch failures and are usually due to on-board engine or attitude control failures or related propellant systems.

When it came to identifying underlying causes, it was often hard to divide design and quality control issues, but these individually or as an indivisible pair were responsible for most spacecraft anomalies. They are both controllable to some extent, so taking care of these should increase reliability. It was also noted that, while the effect of solar/geomagnetic events were not the primary cause of insurance loss anomalies, they were often present as secondary causes. It would be advantageous to record and analyse these in future to give a more complete picture of causes and consequences.

Another difficulty is that space underwriters often introduce policy exclusions on certain subsystems if a generic issue is found on a satellite platform family. This can affect analysis of a certain subsystem’s reliability given that further insurance loss claims will be prevented, even if serious anomalies still exist.

More worrying for insurers is that while the spacecraft-related launch and in-orbit insurance loss rate had been falling, this trend apparently stopped around 2018 and has recently started to rise. This may be related to new technologies such as large antennas and needs further investigation.

Postscript

Since this research was performed, some insurers reported that some of the claims announced in 2024 were actually linked to events that transpired in 2023. This was not a common occurrence, however, and as such the results presented here are negligibly impacted. These include a claim for the first four SES O3b mPower spacecraft which had intermittent power disturbances, and a claim for one of pair of SARah Passiv spacecraft suffering faulty antennas/deployments.

Editor’s note

This article is based on a paper (IAC-24-D5.IP.16) presented as an Interactive Presentation at the International Astronautical Congress (IAC) in Milan in October 2024. The facts and statistics presented in this article are available or derived from Slingshot’s Seradata database. If you are interested in learning more about Seradata, or leveraging it for your own research, please visit https://www.slingshot.space

About the author

David Todd is Lead Space Analyst for Slingshot Aerospace, with overall responsibility for the Seradata launch and satellite database, and Editor of Seradata’s news service, Seradata Space Intelligence. David has been a space analyst and consultant since 1997 and has worked in similar roles for Airclaims, Ascend and Flightglobal. Most recently, he has been instrumental in the development of the latest version of the Seradata database.