A UK Government strategy document set the tone for the country’s space expertise, cementing its leadership in all forms of satellite technology, large and small. Challenges remain for UK space businesses, from developing hardware and delivering it at the right time to ensuring that companies have sufficient funds and staff with the right skills. But the outlook remains very positive and the UK’s sector looks set to grow in line with forecasts in the years ahead

The UK has benefited from a resurgence of interest and commitment to the space industry over last few years. The UK Government’s Innovation and Growth Strategy initiative was launched in February 2010 to look at the potential for the space industry to grow over the subsequent 20 years1. Ever since, the impressive accomplishments of the UK space industry have been more fully recognized.

Tiny satellites called CubeSats are jettisoned from the International Space Station

Tiny satellites called CubeSats are jettisoned from the International Space Station

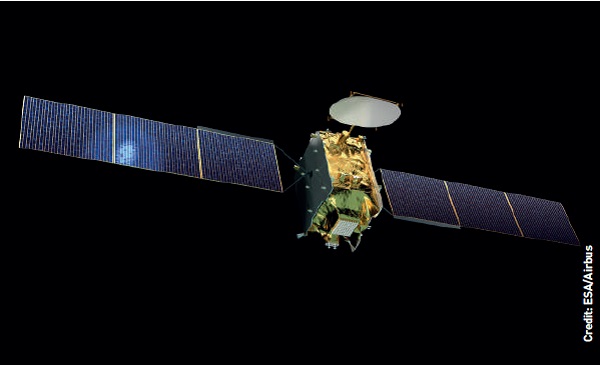

The continued commercial successes of the sector, even during times of recession, have identified it not merely as a technological achievement but a significant source of revenues and a generator of highly-skilled jobs for scientists and engineers. The UK has consistently punched above its weight as far as the international space industry is concerned. It has a significant, indigenous space manufacturing capability and expertise in designing and manufacturing space-borne instruments. It has the capability to deploy a full range of spacecraft, from ‘cube-sats’ and other small-satellites2 to the largest multi-mission telecommunications spacecraft. Indeed, the UK has a strong and long-standing heritage in most types of space system.

The UK has joined The Netherlands, Germany and Italy in hosting Incubation Centres on its shores

Many of the most successful commercial space developments in the UK have come from collaborations between academia and space industry3. There’s a strong track record of engineering achievements combined with entrepreneurial abilities and commercial insight in seeing them through to create world-leading space businesses.

An intensive and wide-ranging study undertaken five years ago, initiated by the UK Government of the time and involving most of the major space companies and space research institutes, took an in-depth look at the potential for UK Space over the following two decades. Fresh from the economic shocks of 2008 and the desire to look for opportunities to create national wealth in a time of recession, the potential for the UK space sector to significantly increase revenues and provide a significant increase in highly-skilled jobs seemed like an ideal opportunity4. The resulting reports from the various Innovation and Growth teams, looking at various facets of the industry, provided a very positive outlook.

The intervening years have seen a significant and broad commitment to UK Space. This increased commitment has been a major driver for the European Space Agency to establish a centre in the UK. It’s located in Harwell, Oxfordshire – a site that is growing rapidly in what seems to be a mutually-supportive manner5. Regular updates and reviews are carried out to ensure that the development of the sector is on course. Indeed, the absolute value of space business secured by the UK in recent years has increased substantially, side-by-side with the growth of space companies. Many of these businesses are in the downstream6 sector.

Incubating businesses

Seen traditionally as the larger of the two portions of the space industry, in roughly a 70% / 30% split, the downstream sector was seen as the area with greater potential for new businesses to be created for using space data and providing new services. One example has been ESA’s Business Incubator scheme to help establish and grow new business by locking newcomers into its network of support centres. The UK has joined The Netherlands, Germany and Italy in hosting Incubation Centres on its shores7. The University of Surrey, with its links to spin-out company Surrey Satellite Technology Ltd, has produced a similar centre and funding network for space business innovations.

Quantum satellites can be changed in space to alter their coverage, frequency bands and even orbital positions

Quantum satellites can be changed in space to alter their coverage, frequency bands and even orbital positions

The continuing success of the UK space industry has created a number of new opportunities, both direct and indirect. With a larger contribution to the European Space Agency’s budget coming from the UK, more is coming back to the UK in terms of absolute geo-return (the process by which ESA ‘returns’ the money to the UK in the form of industrial contracts). Indeed, at times it has resulted in the UK being over-returned in terms of funding coming back.

There are also indirect benefits. Businesses in other countries, including the US and the Far East, are seeing the UK as a good place to establish a business base and are setting up operational sites as gateways into the rest of Europe.

Business growth for space companies inevitably translates to new technology development, whether it’s new hardware, software and applications, or services. For many space companies, there are many barriers to commercial success:

Developing new technology is high risk

Space projects tend to be long term

A space project profile is often incompatible with external funding sources

New development often has to be traded off against maintaining business continuity – an opportunity cost

Development work is high risk not only because new technology can often be overtaken by emerging technology with increased capability, but also because of added constraints associated with space deployment. Hardware, for example, needs to undergo a long and challenging qualification process to ensure it will operate under all conditions in a space environment. It can often be difficult to gauge the size of the market and to estimate when a technology is truly disruptive. This makes future Returns on Investment and their Net Present Value difficult to estimate.

Funding routes

Projects are often long term. When developing hardware for space systems, accommodating the product on a space platform will be tied to the space system implementation time-frame, which could be several years. Hardware needs to be ready for integration at the right time, side-by-side with achieving a minimum level of performance over the range of environmental conditions experienced in space.

Entrepreneurs celebrate the economic value of space activities at Harwell Campus, Oxfordshire

Entrepreneurs celebrate the economic value of space activities at Harwell Campus, Oxfordshire

A space project is often incompatible with traditional sources of funding. Taking into account the long project timescales and the risks associated with high-technology development, the profile is often not attractive to an investor. This often then requires establishing a supplementary source of income for small businesses, or significant commitment by the business to earmark risk capital to the development of its product portfolio. In other words: someone has to take the risk somewhere.

A space resource specialist provider such as Grafton Technology can be a strategic partner in supplying the right skills

Public funding can often come to the rescue. Again, the UK is a supportive environment in which to develop new products in view of the many sources of early-stage development funding available. Innovate UK8 is an excellent organization administering UK Government funding through many competitive funding schemes and awards. Having mitigated the highest levels of early stage developmental risk, this often opens doors to subsequent funding routes.

Finally, development risk is an opportunity cost for any business. Funds could often be used for maintaining and updating an existing product line instead. The smaller the business, the less possible it is to use existing funds or to keep revenues going while designing and developing the new space product or application.

For all the reasons above, it is becoming increasingly important for SME space companies to control costs while getting their new technology to market. A trade–off needs to be made, for example, between cash flow and having enough people to undertake the work. An early-stage business, or a business that is moving into a new product area, will not want to increase its business risk by taking on full-time staff while project workflows are volatile.

To some extent, however, this is the more manageable of the risks for the business. Technology risk will depend on competitors both known and unknown, and investors are notoriously individual and unpredictable. Staffing and cash flow, on the other hand, are far more predictable and to a larger extent controllable.

Flexible staffing

This new paradigm will involve managing costs by controlling and deploying resources that need to be flexible and adaptable to serve short- and medium-term needs. For an early stage company – and for some that have been around much longer – human resources are the most significant recurring expense.

One way of solving the conflict between controlling staff costs and getting the work done is to flexibly adapt the level of resources to the work in hand. Flexibility means not having to tackle a fluctuating level of work and specialisms within the team by having a fixed staff set able to address an average level of work.

Another key benefit when looking at a flexible staffing solution is having suitable personnel pre-screened by an organization with a pedigree in the space industry. This will eliminate the need to sift through large numbers of unsuitable CVs and highlight candidates who match the requirements. A space resource specialist provider such as Grafton Technology9 can be a strategic partner in supplying the right skills into the team at the right time, flexing the team size to suit near-time project objectives, lowering risk for the business and reducing overall costs.

Time. Resources. Funds. These are often in short supply and always worth taking care of. The new paradigm is flexing the team in phase with the workload. Every space business will immediately appreciate the benefit, and ultimately this could represent a make-or-break for business performance and even survival.

Our assessment of the future for the space sector in the UK is very positive. We see space continuing to grow at around 9% per year, in line with forecasts. UK businesses will continue to step up to the plate and compete for space business across the world and will remain world-class players.

The entrepreneurial ambition is also alive and well in the UK and this will drive new business creation and growth. Being able to support both space businesses in their early growth phases and those continuing to grow will contribute to optimising the wealth-creating space businesses of tomorrow.

References

1 The official report from the UK space agency - Innovation and Growth Strategy: update report 2015 – https://www.gov.uk/government/publications/update-report-uk-space-innovation-and-growth-strategy-2015

2 For further information follow the link to Clyde Space - http://www.clyde-space.com/

3 Surrey university with research and development facilities and well known a spin-out company SSTL - http://www.surrey.ac.uk/ and http://www.sstl.co.uk/

4 Find out more about opportunities for young people on The Case for Space and Rutherford Appleton Laboratory (RAL) - http://www.caseforspace.org/ ;

http://www.ralspace.stfc.ac.uk/ralspace/

5 See more information from ESA’s publications on working at the Harwell site - http://www.esa.int/For_Media/Press_Releases/Call_for_media_First_ESA_facility_in_UK_-_a_catalyst_for_growth ; http://www.esa.int/ESA_in_your_country/United_Kingdom/Breeding_ground_for_young_space_spin-off_firms/(print) ; http://www.esa.int/About_Us/Welcome_to_ESA/ECSAT

6 Upstream relates to the space system itself; downstream relates to the usage of the spacecraft: the services enabled by the use of the spacecraft (the user applications; the disaster monitoring; the GPS/GNSS services, etc.)

7 Reference to the presence of ESA Incubators elsewhere in Europe - http://www.esa.int/Our_Activities/Space_Engineering_Technology/Business_Incubation/ESA_Business_Incubation_Centres4

8 Link to Innovate UK – page for general introduction - https://www.gov.uk/government/organisations/innovate-uk and collaborative funding - https://www.gov.uk/government/news/nine-uk-companies-get-set-for-space-mission-to-the-united-states

9 Link to Grafton – http://www.graftontechnology.co.uk/