The 2020s have already proved to be an unprecedented decade in many ways. The first 16 months brought a global pandemic, economic changes, progressive digitisation and, oddly enough, increased interest in the space sector. The western space sector has seen rapid advancements during this time but, in many ways, the Chinese space sector has grown even more rapidly. Here, the author examines the story so far and what we can expect from the Chinese space sector over the remainder of the decade.

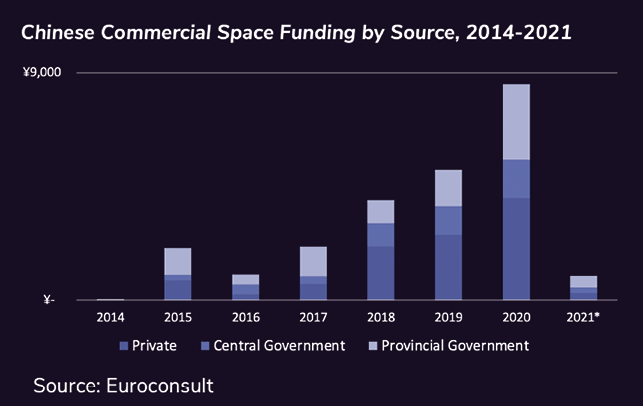

The word ‘commercial’, in the context of China, refers to a company with the primary goal of making money, as opposed to selling to government, building infrastructure, or having other non-commercial motives. Most commercial companies are privately or semi-privately owned, and around half of funding comes from venture capital (VC), with the other half provided by local or provincial government.

Some commercial companies are spinoffs or direct subsidiaries of the somewhat impenetrable Chinese state system, which includes the Chinese Academy of Sciences (CAS); China Aerospace Science and Technology Corporation (CASC), the main contractor for the Chinese space programme; and China Aerospace Science & Industry Corporation (CASIC), a state-owned enterprise that designs, develops and manufactures a range of space and defence systems.

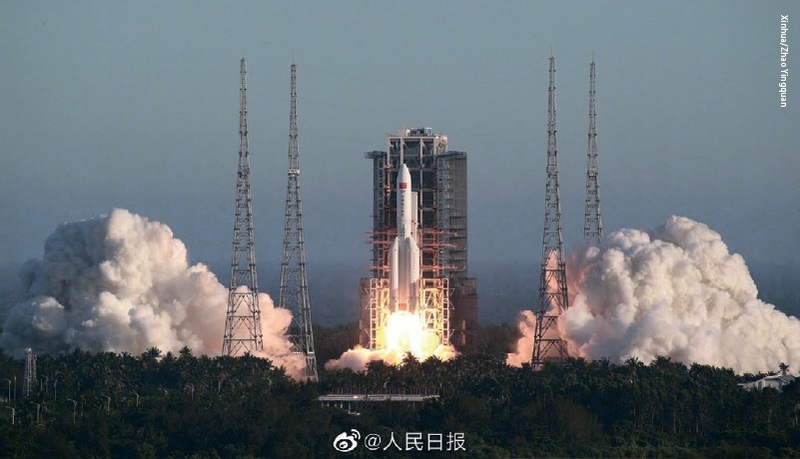

China’s new large carrier rocket Long March 5B blasts off from Wenchang Space Launch Center in south China’s Hainan Province.

China’s new large carrier rocket Long March 5B blasts off from Wenchang Space Launch Center in south China’s Hainan Province.

Generations

The idea of commercial space in China effectively began in late 2014, with the passage of ‘Document 60’ by the National Development and Reform Commission (NDRC)

The idea of commercial space in China effectively began in late 2014, with the passage of ‘Document 60’ by the National Development and Reform Commission (NDRC), which allowed for investment into certain parts of the space sector. This led to the ‘first generation’ of Chinese commercial space companies, including launch companies Landspace, iSpace, OneSpace and Expace, and the satellite manufacturers Commsat, Space-OK and CGSTL. Some of these have since flourished, while others have either expired or had to pivot markedly.

Over the latter half of the 2010s, we saw more than 100 commercial space companies emerge from China, many of which came with a team of founders from state-owned enterprises (SOEs). However, quite a few were created by founders or early employees from first-generation commercial space companies. One example is the ‘second-generation’ commercial launch start-up Tianbing Aerospace, founded in 2019 by a former CTO of Landspace, a first-generation launch start-up founded in 2015.

Ultimately, the latter half of the 2010s created a large and growing ecosystem of Chinese commercial space companies, many of which had raised generous sums from VCs. Meanwhile, others were actually earning revenues in a number of creative ways: for example, the video satellite launched by millennial-focused video website Bilibili, which was manufactured by commercial Earth observation company Chang Guang Satellite Technology (CGSTL).

These developments, combined with expansion of the civil space industry more generally, placed China’s commercial space industry on the precipice of an historic decade as we entered the 2020s.

Full-size display model of the core module of China’s new space station Tianhe.

Full-size display model of the core module of China’s new space station Tianhe.

Seeds of disruption

The 2020s in China started in a similar way to much of the rest of the world, with the global coronavirus bringing activity to a halt in the country in the early part of 2020. After a relatively brief but extremely comprehensive lockdown lasting for most of the first quarter of the year, China began to emerge in certain ways, namely by containing the spread of the virus domestically and maintaining strict control over international travel.

The speed of recovery of China’s space sector can perhaps best be examined in the Chinese city most severely-impacted by the virus - Wuhan. Wuhan is noteworthy for being home to several of the commercial space ambitions of the China Aerospace Science and Industry Corporation (CASIC), including the Wuhan National Aerospace Industrial Base. These projects include a factory capable of producing dozens of rockets per year for Expace, as well as a highly automated smallsat factory. The smallsat factory, which will have an eventual capacity of 240 satellites per year, was completed in January 2021, following a design and construction period of just 429 days. The fact that such a sophisticated plant was built in Wuhan, over a 429-day period that included a pandemic lockdown, is nothing if not impressive.

The ascent of China’s commercial space sector in the decade thus far has not been limited to Wuhan, however; a handful of space industry clusters have sprung up around the country as commercial space firms have raised capital and political points in support of their sector. In addition to the CASIC cluster in Wuhan, Chengdu and Sichuan Province in China’s Southwest have seen a flurry of space industry activity over the past year or so.

Rocket factory in Huzhou, Zhejiang, of Landspace, a Chinese private space launch company.

Rocket factory in Huzhou, Zhejiang, of Landspace, a Chinese private space launch company.

Among others, fast-moving commercial launch company Galactic Energy set up operations in Jianyang, and satellite manufacturer Commsat built a satellite factory in Yibin (both cities being nearby the provincial capital of Chengdu). As with many Chinese space industry clusters, the companies around Chengdu span across the commercialisation spectrum. Commsat is originally a spinoff from the CAS, but is now quite commercial. Galactic Energy, by contrast, was founded by an engineer from launcher vehicle manufacturer CALT, and likely has some assistance from CASC, but is otherwise commercially motivated and funded primarily by private VC.

The speed of recovery of China’s space sector can perhaps best be examined in the Chinese city most severly impacted by the virus – Wuhan

Another major player in the local space ecosystem is the China Electronics and Technology Corporation (CETC), a state-owned enterprise with a focus on electronics and components, and with major operations in Chengdu. CETC has several commercial space subsidiaries in the area, including the CETC 10th institute (also known as Tian’ao). These companies are supported by significant research universities in Chengdu, including the University of Electronic Science and Technology of China (UESTC), which recently co-built a satellite with satellite manufacturer MinoSpace.

Smaller clusters with a more specific focus include a major satellite Earth observation (EO) cluster being built in Changchun, Jilin Province, with CAS spinoff CGSTL acting as the anchor. The company has announced the acceleration of deployment of its constellation, while also raising several billion Renminbi (RMB), partly from the provincial government.

Official poster of China Space Day, which was held in April.

Official poster of China Space Day, which was held in April.

During the decade thus far, these clusters have developed rapidly, with cities and provinces ranging from Shanghai to Guangdong and Hainan including space industry development as part of their medium-term policy objectives. This has been assisted by significant national-level support for space during the past 16 months, including the National Development and Reform Commission’s addition of satellite internet to its list of ‘New Infrastructures’ (priority areas of digital infrastructure development).

More recently, early 2021 saw multiple pieces of space-related information in the Five-Year Plan, including the creation of a commercial launch site, the launch of global satcom, satnav, and EO constellations, and the fourth phase of the China Lunar Exploration Program.

Overall, despite the 2020s having begun with a pandemic that shut down China and the rest of the world, the Chinese commercial space sector has emerged rapidly, with a variety of industry clusters developing around the country, and with buckets of funding being poured into commercial space companies. This will prepare China for an interesting rest-of-the-decade in space development.

Expectations

To paraphrase American baseball player Yogi Berra, it’s tough to make predictions, especially about the future of the Chinese commercial space sector. That being said, the country’s development plans are relatively transparent, and a huge amount of money and other resources have already been invested into the sector. So, we can make some general assumptions about how the rest of the decade will play out in Chinese commercial space.

First, we expect to see continued growth of the commercial space sector. While we may not see annual investment figures reach the nine billion RMB or so invested in 2020, we are likely to continue to see investment and, more importantly, increased revenues from companies that mature into later stages of development.

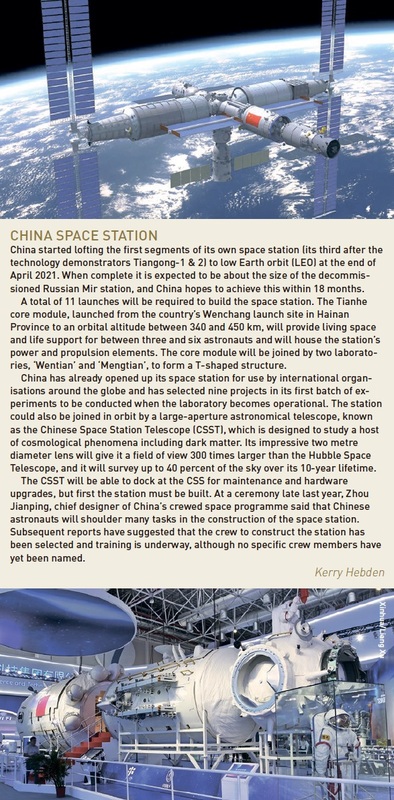

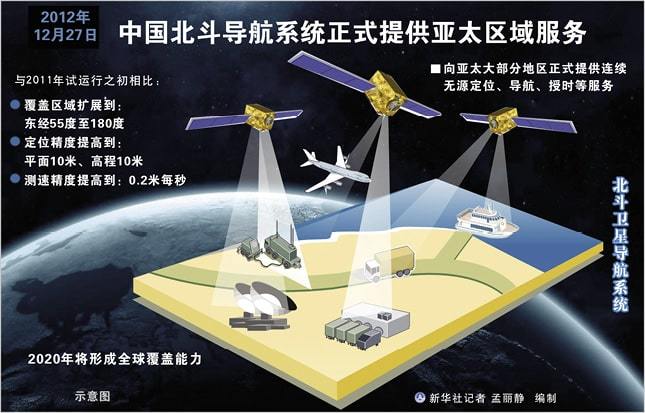

China’s civil space programme will continue to grow, with the China Space Station (CSS) – the third phase of the Tiangong programme – planned for launch later this year, and future Chang’e missions, deep space exploration missions and even human lunar missions planned for later in the decade.

The enormity of these projects and others will increase the number of opportunities for commercial companies, even if for relatively simpler and smaller contributions compared with the state-owned giants. Recent actions by the Central Government, such as the inclusion of a commercial launch site in the 14th Five-Year Plan, are a clear indication that the commercial space sector in China has a long growth runway.

Second, the chickens will come home to roost on some of China’s space excesses. As mentioned above, there are a handful of provinces and cities trying to develop space industrial bases and broader space economies. Many have partnered with commercial companies or SOE subsidiaries and have plans aligned with the national government. Quite a few of China’s more than 100 commercial space companies are sure to be successful, but over the next handful of years, a large number are likely to be absorbed, go bankrupt or otherwise disappear. The recent absorption of Space-OK, one of China’s first commercial space companies, by GeeSpace was one clear example.

A Long March rocket replica at Jiquan complex in the Gobi Desert.

A Long March rocket replica at Jiquan complex in the Gobi Desert.

Another area to watch would be China’s commercial launch sector, where around 20 companies are now competing for what – as in the West - is still a highly uncertain market. Ultimately, over the next several years, one should expect some consolidation among China’s commercial space sector, albeit with the emergence of several highly competitive companies.

Third, we should expect China’s commercial (and civil) space sector to increase its international activities. Over the first seven or eight years of the commercial space sector, a handful of adventurous Chinese firms established overseas subsidiaries, often in countries such as Luxembourg or France.

If the first year-and-a-bit of the 2020s are any indication, China’s future space activities will be impressive

Moving forward, there is likely to be more business done between China and the rest of the world in the space sector, possibly supported by increased government-to-government collaboration. For example, at the end of 2020, China and Italy celebrated 50 years of diplomatic relations, during which time the two countries noted space as one area for future collaboration.

The past couple of years have also seen China launch satellites for Ethiopia and Sudan, and Chinese subsystems component suppliers selling into other countries. This international effort has been supported by the national government through initiatives such as the Belt and Road Spatial Information Corridor, which is likely to remain in the coming years.

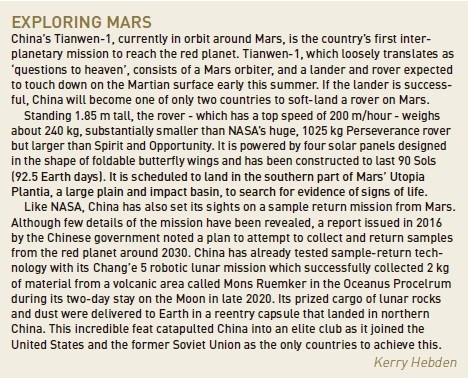

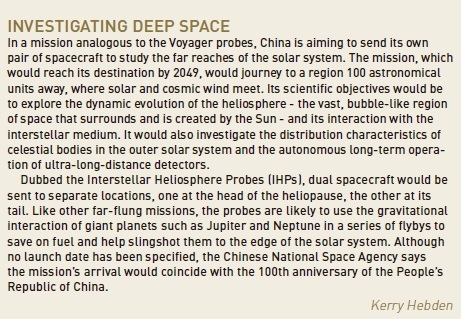

In just over three decades China’s BeiDou Navigation Satellite System (BDS) - named after the Chinese term for the Big Dipper constellation - has achieved a range of goals, such as shifting from active to passive positioning and expanding its service coverage from China to the Asia-Pacific region.

In just over three decades China’s BeiDou Navigation Satellite System (BDS) - named after the Chinese term for the Big Dipper constellation - has achieved a range of goals, such as shifting from active to passive positioning and expanding its service coverage from China to the Asia-Pacific region.

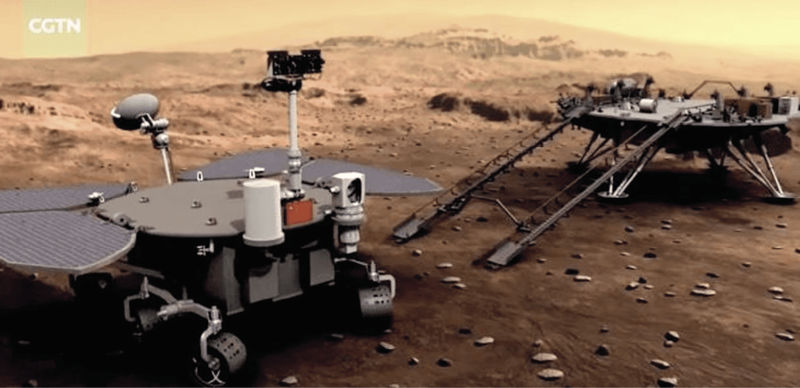

Finally, there will be increased emphasis on utilisation of space assets, rather than deploying many more space assets, in some areas. As an example, China recently completed deployment of its third-generation BeiDou satellite navigation constellation. While this will need to be replenished, that will occur towards the end of the decade. Similar dynamics exist in EO (with many Gaofen and Yaogan satellites launched in recent years), but in both areas there is an opportunity to make more use of existing space assets.

The word ‘applications’ has been a major buzzword in recent years in China, and this will likely increase markedly with the rollout of a global communications constellation to complement existing EO and satnav constellations.

Module for China’s space station, the first part of which was launched at the end of April 2021.

Module for China’s space station, the first part of which was launched at the end of April 2021.

So, if the first year-and-a-bit of the 2020s are any indication, China’s future space activities will be impressive. With more ambitious government space programmes, more diverse commercial companies, and the involvement of a variety of sub-national governments, we are likely to see dozens more companies, billions more RMB, and a lot of rockets thrown at the plethora of requirements for the growing space economy.

While this will inevitably lead to some challenges and growing pains, China’s continued rise in space also represents an opportunity for those who can separate the signal from the noise, and adjust to the rapidly changing realities of the space sector in the Middle Kingdom.

About the author

Blaine Curcio is a space and satcom industry expert and longtime China watcher based in Hong Kong. He is founder of Orbital Gateway Consulting and Senior Affiliate Consultant at Euroconsult, where his areas of focus includes the global satcom industry, Chinese space industry and LEO broadband constellations. Blaine is co-host of the Dongfang Hour, the first and only podcast about the Chinese space and aerospace sector, and is a regular contributor to industry publications.