China’s space achievements have been well-documented: three space stations, multiple lunar missions including a sample return, plans for a Lunar Research Base and a number of Mars missions, to name but a few. In parallel, China has increased its international space collaboration. Here, Blaine Curcio provides an overview of China’s historical international space collaboration, before examining some of the recent developments in the sector and looking at what the future may hold for Chinese international space cooperation.

In recent years, space has captured the imagination in a way not seen since the original space race of the 1960s. The rush of money and talent into the space sector has led to companies and space agencies doing amazing things that could not even have been dreamt of a few decades ago. Who could have imagined in the year 2000, for example, that SpaceX could reach scalable reusability on large launch vehicles or that China would by now have launched three fully-functional space stations?

These incredible achievements have brought space into the public domain and, as more people start to pay attention, governments are lining up to create new national space agencies. Since 2016, New Zealand, Australia, Luxembourg, Uzbekistan, Portugal, Greece, El Salvador, Azerbaijan and Costa Rica have thrown their hat into the space industry ring, with each of these countries having created a space agency in the past six years.

Most of these nations have relatively small populations and limited resources to pour into space, but this has created opportunities for larger, more established space nations to partner with them. New Zealand, for example, has a population of just over five million and is unlikely to be able to justify its own space station or lunar mission anytime soon, but the country signed up to the US-led Artemis Accords in June 2021. Meanwhile, its neighbour Australia, having founded its own space agency just four years ago, signed with Artemis in late 2020.

As these new space agencies assess their options for taking part in large-scale projects as a junior partner, there will be a few options. The most obvious, especially for countries such as Australia and New Zealand, would be to partner with the US (NASA) or EU (ESA) for large projects. But for emerging space nations that are less aligned with the west, there is another option that is becoming increasingly viable: China.

Images of the failure of the Long March rocket carrying Intelsat-708 on 15 February 1996.

Images of the failure of the Long March rocket carrying Intelsat-708 on 15 February 1996.

Transactional space collaboration

China’s space sector began in earnest with the launch of the country’s first satellite to reach orbit, Dongfanghong-1, on 24 April 1970

China’s space sector began in earnest with the launch of the country’s first satellite to reach orbit, Dongfanghong-1, on 24 April 1970, a date that has since become China’s official ‘Space Day’.

International cooperation in the programme’s first two decades was primarily technology transfer from countries such as the Soviet Union. Starting in the 1990s, however, China began to provide launch services to foreign customers. Services were provided through China Great Wall Industry Corporation (CGWIC), a subsidiary of the China Aerospace Science & Technology Corporation (CASC), China’s largest space contractor. CGWIC’s role in the Chinese space ecosystem is to act as a broker or ‘service provider’ for the Chinese traditional space sector, working with various CASC subsidiaries to procure turnkey offerings including satellites, launches, telemetry and tracking (TT&C) services, and so on.

The first launch for a foreign customer by China was the AsiaSat-1 satellite, launched for (then British) Hong Kong-based AsiaSat in April 1990. At the time, Chinese rockets were seen as a somewhat reliable, low-cost option to get to space. Follow-on missions in the early 1990s included multiple Optus satellites for Australia-based AUSSAT (since renamed Optus), another mission for (still British) AsiaSat in 1995, and missions for Hong Kong-based APT Satellite Holdings.

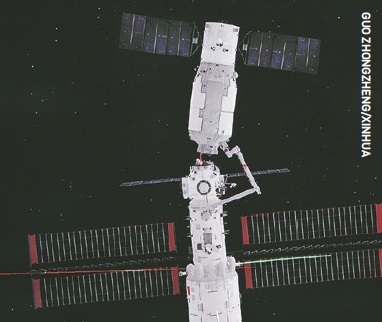

A robotic arm repositions the Tianzhou 2 cargo spaceship during a test at China’s Tiangong space station on 6 January 2022.

A robotic arm repositions the Tianzhou 2 cargo spaceship during a test at China’s Tiangong space station on 6 January 2022.

The success rate of these initial international missions was not high, with three failures and one partial failure in 11 launches for foreign customers from the first launch (AsiaSat-1) up until the devastating loss of Intelsat-708, which occurred in February 1996 and led to multiple deaths near the launch site.

The Intelsat-708 failure, and the earlier failure in 1995 of Apstar-2, marked a major turning point in China’s international space collaboration. In the months following the failures, American companies Hughes and Space Systems Loral (manufacturers of Apstar-2 and Intelsat-708, respectively) worked with Chinese authorities to understand the cause of the launch failures, and in the process shared with them potentially sensitive technological information related to rocketry. Arguably, as a consequence, the reliability of the Long March rocket family increased dramatically thereafter, and did not experience another failure until 2011.

However, this information sharing led, among other things, to a $14 million fine paid by SS/L to the US State Department, and a rapid tightening of US export controls for satellite technology. While the ensuing couple of years would see a few more US-made satellites launched on Chinese rockets (several Iridium satellites, for example), the dual failures in the mid-1990s signalled the beginning of the end of China’s early international space collaboration. No longer was China a viable option for western countries hoping to launch their satellites and the nation needed to pivot.

Artistic representation of China’s proposed International Lunar Research Station (ILRS).

Artistic representation of China’s proposed International Lunar Research Station (ILRS).

New millennium, new business models

It has ultimately proven cumbersome for China to sell US$300 million turnkey projects to developing countries

As we entered the 2000s, China’s space sector was growing rapidly, partly enabled by increasingly reliable Long March rockets and supplemented by major advancements in communications and remote sensing satellites. Thus, China began a new type of international space sector collaboration by exporting turnkey satellites to developing countries.

The first such project was NigComSat-1, a large geostationary (GEO) communications satellite built for Nigeria. The deal was signed in 2004 and the satellite was launched in mid-2007. In a sign of growing pains that occur with any new business model, the NigComSat-1 satellite failed in-orbit after about 18 months due to an issue with its solar arrays. Several years later, China built and launched the replacement NigComSat-1R, which remains in orbit to this day.

Other turnkey satellite projects completed by China during this time include VeneSat-1 (built for Venezuela and launched in 2008), PakSat-1R (Pakistan, 2011), Tupak Katari (Bolivia, 2014) and LaoSat-1 (Laos, 2015). These projects typically involved Chinese satellites, launch vehicles, TT&C infrastructure, insurance and financing (through the Export/Import Bank of China), and were brokered by the above-mentioned CGWIC.

While the satellites surely brought some benefit to the recipient countries, it has ultimately proven cumbersome for China to sell US$300 million turnkey projects to developing countries (Laos’ total GDP in 2015, when LaoSat-1 was launched, was US$14B, meaning LaoSat-1 would have cost some two percent of GDP). The global satcom industry has also seen a downturn in GEO communications satellite orders since the mid-2010s, partly due to fewer countries purchasing so-called ‘PrideSats’.

Indeed, the most recent such project announced by China was the Techo-1 satellite for Cambodia, announced with much fanfare at the beginning of 2018, in a meeting that included Chinese Premier Li Keqiang (the nation’s number-two political figure). The project has since seen no publicly announced progress and may have already been cancelled. With the market for large GEO comsats suffering a downturn, China once again pivoted in its international space collaboration methods, towards launching more Chinese-built infrastructure and inviting foreign partners to use it.

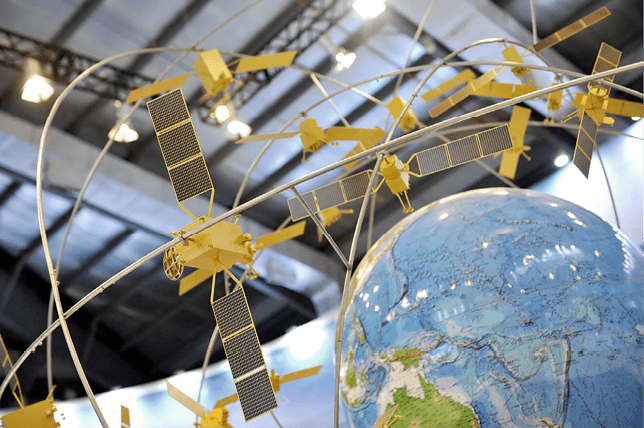

A model of the Beidou Navigation Satellite System.

A model of the Beidou Navigation Satellite System.

Spatial Information Corridor

In September 2013, Chinese President Xi Jinping gave a speech at Nazarbayev University in Nur-Sultan (at the time still called Astana), Kazakhstan, during which he made the first reference to China’s Belt and Road Initiative (BRI). The all-singing, all-dancing Eurasian infrastructure plan aims to more closely integrate China, Eurasia, Africa, and even Latin America, through a network of ports, railroads, highways, airports and other physical infrastructure.

Since the end of the 2010s, we have seen a steady stream of impressive firsts from China

At the same time, there are multiple digital components of the BRI, notably the Digital Silk Road, and more importantly for the space sector, the Belt and Road Spatial Information Corridor (BRI SIC).

BRI SIC envisions a global network of space infrastructure including Earth observation communications and navigation constellations, supporting ground equipment, and a variety of terminals and applications to utilise the space infrastructure. Largely financed by China, the BRI SIC uses a completely different economic model from China’s previous international space collaboration.

Take satellite navigation as an example. China completed deployment of its third-generation BeiDou satnav constellation in 2020. During and after deployment, companies such as CGWIC have expanded their reach overseas to export satnav applications, including the opening of a representative office in Cambodia in 2021 with plans to integrate BeiDou equipment into the Cambodian logistics and transportation sectors.

In the satellite communications sector, China has made it clear that it plans to launch a LEO broadband constellation, and state-owned satellite operator China Satcom has announced plans for geostationary high-throughput satellites (HTS) across the broader Eurasian region. Similar to BeiDou, rather than selling the space-based infrastructure and hardware to developing countries, China is building and operating the infrastructure for itself and selling services to partner countries.

In other words, it is easing the capital expenditure burden on partner countries, but at the same time also limiting the degree of control and autonomy that partner countries can have. It may be cheaper, and ultimately ‘better’ for Cambodia to lease Chinese satellite capacity rather than buying a Chinese satellite for themselves, but in the end, leasing Chinese satellite capacity does leave Cambodia open to China’s whims.

Ultimately, China’s more recent strategy of building and operating its own space infrastructure, and giving countries the option to utilise it, undeniably gives these other countries more options. Rather than having only three global satnav constellations (GPS, GLONASS and Galileo), countries like Cambodia can now choose from four. More bargaining power for them? Yes. Net positive for them? Possibly.

Moving forward, however, China has its eyes on using even more rarefied space infrastructure for international collaboration: human spaceflight, interplanetary missions and research bases on the Moon.

Superview series of satellites, Triplesat and Changguang 1 provide commercial data service for countries along Belt and Road, to support data application evaluation based on national characteristics.

Superview series of satellites, Triplesat and Changguang 1 provide commercial data service for countries along Belt and Road, to support data application evaluation based on national characteristics.

International cooperation

Since the end of the 2010s, we have seen a steady stream of impressive firsts from China. In 2019, it became the first country to land on the lunar farside with the Chang’e-4 rover, while in 2020 it launched its first Mars mission which included an orbiter, lander and rover. And in the early 2020s China has deployed its long-term space station, the China Space Station (CSS), with impressive efficiency. Later in 2022, the CSS will increase its capacity from three to six taikonauts following the arrival of the Wentian lab module, which includes more living quarters.

All of this means that China has a lot of ‘new toys to play with’ in orbit, and it has recently made it clear that the toys are there to share with international friends. In 2021, for example, China jointly announced with Russia the International Lunar Research Station (ILRS), a project aiming to establish a long-term presence on the Moon. As the name implies, the project is open to all international partners.

Looking at China’s space ambitions for the 2020s… it is clear that there will be ample opportunities for other countries to collaborate

Then, in early 2022, China’s State Council Information Office published the nation’s space programme in a White Paper. The word ‘international’ appears in the document 59 times (while China appears 167 times) and almost every major mission discussed in the paper has an international component. As the paper notes, since 2016, China has signed 46 space cooperation agreements and/or MoUs with 19 countries and four international organisations.

The White Paper also makes specific reference to collaboration with Pakistan, Egypt, Tunisia, Saudi Arabia, Argentina and others. The paper also notes several “Key Areas for Future [International] Cooperation”, which include global governance of outer space, manned [human] spaceflight, satellite navigation, deep-space exploration, space technology, applications and space science. In short, a lot of support for international collaboration moving forward.

Finally, in March 2022, we saw the annual Two Sessions, a pair of major political conferences in Beijing. Previous meetings have seen more senior officials talk about space, but this year was unprecedented. Notably, Zhou Jianping, Chief Designer of China’s Manned Space Programme, said that China looks forward to welcoming foreign astronauts on the CSS after its completion, which will occur in late 2022.

The timeline for international astronauts was not made clear but, given the sensitivity involved with sending one of the best and brightest from another country into space and housing them on your space station, this would clearly involve a major step forward in international collaboration between China and partner countries.

When looking at China’s space ambitions for the 2020s (continued CSS habitation, at least three uncrewed lunar missions, a global LEO broadband constellation, etc), it is clear that there will be ample opportunities for other countries to collaborate. But if China builds it, will they come?

Future trends

Despite all the efforts poured into international collaboration in space, China’s space sector, even today, remains very domestically-focused, while an increasing number of countries are becoming suspicious of China’s space activities. Meanwhile, that potential flagship international programme, the ILRS, has been badly tainted by Russia’s invasion of Ukraine. If ESA, or individual European space nations, were considering signing up to ILRS before, this seems unlikely now.

At the same time, developed space countries are gradually taking a page out of what has historically been a Chinese playbook, namely focusing on domestic production and self-sufficiency; look no further than the revocation of Starlink’s operating license by French authorities in April. This could have been for any number of reasons, but pragmatically and realistically speaking French interests in a domestic LEO broadband constellation were probably a not small factor. If Starlink has such difficulty in accessing France, it is hard to imagine the difficulties that a Chinese competitor would encounter.

Chinese and Cambodian representatives from government and industry met in January 2018 to tighten relations between the two countries, including collaboration on China’s Belt and Road initiative.

Chinese and Cambodian representatives from government and industry met in January 2018 to tighten relations between the two countries, including collaboration on China’s Belt and Road initiative.

So the global macro environment is changing and this will complicate the calculus for any international space collaboration. It may no longer be enough for China to build infrastructure and then rent it to other countries; in fact, it may no longer be enough for China to go back to its 2000s strategy and sell countries the technology turnkey. Moving forward, it is possible that, if China wants to sell a satellite to a developing country, it will need to help that country make the satellite itself.

Despite all the efforts poured into international collaboration in space, China’s space sector, even today, remains very domestically-focused

The outcomes of these different push and pull factors are hard to predict, but we can safely expect a few trends to continue:

- The space industry will continue to see more stakeholders - countries, companies and other actors - involved in the sector.

- Most entities will not have comprehensive space capabilities, which means that for the few players that can afford space stations, lunar missions, etc, there will continue to be opportunities to take junior partners.

- Space will continue to play a bigger role in the broader economy, and as a result, will become more politically important than today.

- New entrants will want to invest more into the space sector, which is good for established players, but at the same time, the increasing strategic importance of space means that even new players will want more autonomy and self-sufficiency than before.

What role China will play in all this is yet to be defined but, ultimately, the trend lines are clear. China has evolved indisputably into the world’s second-leading national space power after the US, and has spread its international space influence in a similar manner to other sectors of the economy.

The Chinese space sector has come a long way since its first satellite launch in 1970. International collaboration has evolved from transactional rocket sales in the 1990s to talk of highly integrated human spaceflight cooperation in the 2020s. Perhaps most impressively, we might still be at the beginning of a long-term uptrend in space collaboration.

We cannot know what the future of the global space sector holds, but it seems safe to say it will be more multipolar, with China playing an increasingly important role.

About the author

Blaine Curcio is a space and satcom industry expert and longtime China watcher based in Hong Kong. He is founder of Orbital Gateway Consulting and Senior Affiliate Consultant at Euroconsult, where his areas of focus includes the global satcom industry, Chinese space industry and LEO broadband constellations. Blaine is co-host of the Dongfang Hour, the first and only podcast about the Chinese space and aerospace sector, and is a regular contributor to industry publications.