I recent years, the overall trend in space exploration development has been to increase access to space and lower the entry threshold for space activity. This trend is expressed in the noticeable boom in small spacecraft (SSC) production. Traditionally, SSCs include the following satellites: femtosatellites (10-100g), picosatellites (up to 1kg), nanosatellites (up to 10kg), microsatellites (up to 100kg), minisatellites (up to 500kg).

The boom is evident in the drastic increase in the number of launched small spacecraft – from 49 in 2012 to 125 in 20131. Analysts agree on the overall assessment of SSC segment growth, though they differ in their view of the dynamic pattern. Thus, some say that in 2020, 195 SSCs will be launched2, while another source claims that 543 spacecraft3 will be launched in the 1-50 kg category alone.

Traditionally, the main SSC developers were universities and scientific organisations that used SSCs for academic purposes and technological solutions. However, in the last few years, commercial companies have become the main driving force behind the growing microsatellite market. It is expected that between 2014 and 2015 they will launch up to 366 micro- and nanosatellites, which will account for up to 56% of the SSC market in this segment4. Another market player developing small spacecraft are government bodies that initiate their own space programs5.

The reason behind this segment’s growth is the low cost of getting an SSC into orbit, due to their small mass. At the same time, miniaturisation and perfection of components used in their manufacturing lead to increased functionality, which is more and more frequently offsetting the difference between small and large spacecraft.

Standardisation achieved by adapting the CubeSat standard plays a big role in lowering production costs of SSCs. CubeSat is an SSC module architecture, which assumes the use of form-factor cubes with 10 cm sides and weighing about 1 kg. The standard implies the ability to build larger craft by joining together a number of cubes within one satellite. The prognosis is that craft using this standard will be the driving force behind microsatellite market growth until at least 2020.

Traditionally, the main SSC developers were universities and scientific organisations

Maximum unification and standardisation of components, the use of a consumer grade electronic component base (ECB), refusal of independent development or purchasing of small-series (and therefore, expensive) radio-electronic devices also help drastically reduce the cost of development and manufacturing of a single craft. This helps small and medium companies lower the entry threshold into space markets, and allows developers to concentrate on developing technical solutions (such as, for example, a sun sail demonstrator), or work on questions relating to the expansion of a large constellation and its use. The use of standard form-factors also allows the launch agreement procedures to be simplified, due to the standard fastening and kick-off mechanisms launched by the concurrent launch from the launch vehicle.

It is logical that companies that produce and manufacture SSCs see new services (such as Skybox Imaging) as the main source of income

Another reason for the increasing amount of spacecraft planned for launch is the enlargement of small spacecraft constellations. It should be noted that while large spacecraft constellations are comprised of only a few individual spacecraft, microsatellite constellations include dozens of spacecraft and are produced in series.

How did we get here?

Why is this happening? Firstly, a large number of spacecraft provides a higher periodic rate of flying over a given point of the earth’s surface, thereby increasing the temporal resolution of received data (first and foremost – photographs of the surface), which can potentially lead to the creation of new applied services.

Secondly, due to the economy of scale, the cost of one spacecraft is decreasing, although in all fairness it should be noted that there hasn’t been a radical drop in the overall cost of constellation support due to the short active performance time of each spacecraft. Thirdly, a large amount of spacecraft could serve as an instrument of risk hedging: the loss of a single craft does not have a significant influence on the constellation’s overall functionality.

This is the case for large spacecraft constellations as well, however, it is possible for SSCs to drastically reduce the cost and manufacturing time of a single unit, thereby reducing production times and cost of the beginning of active operations for a satellite constellation (when compared to large spacecraft constellations).

Big companies miss out?

Another reason the small spacecraft market is attractive to new players is that the cheap spacecraft segment is unattractive to large companies, who are used to taking on big projects financed through the cost-plus structure.

A part of the Googleplex, Google’s original corporate campus. The company has recently announced that it is branching out into the satellite broadband internet business

A part of the Googleplex, Google’s original corporate campus. The company has recently announced that it is branching out into the satellite broadband internet business

Therefore, working with small spacecraft can become the base for new space business development.

New business models are also getting a trial run. It’s widely known that the main profits in space businesses are generated from offering services to various levels of consumers in telecommunications, Earth remote sensing and navigation.

It is therefore only logical that companies that produce and manufacture SSCs see new services (such as Skybox Imaging with their video recordings of the Earth) as the main source of income, instead of the sale of spacecraft to operators, as is the case with big spacecraft (for instance, heavy communications spacecraft in geostationary orbit). As a result, vertical integration occurs in these SSC developing companies.

Previously, space companies did almost everything themselves (including making bolts and microcircuits) and left the largest chunk of profits to spacecraft operators, but now components are purchased elsewhere, and companies see satellite production as one of the interim steps in their business, receiving profit not from the sale of spacecraft, but from their exploitation.

Where the real competition is

Therefore, different models currently on the market vary in their proximity to the final consumer: from providing data to the operators to full vertical integration within the company. New players, such as Planet Labs, Dauria Aerospace and the aforementioned Skybox Imaging are competing with operators such as Digital Globe, and not so much to industry old-timers such as Boeing or Thales Alenia Space.

Using such models gives space startups a chance to find their place on the market, which in turn requires a clear understanding of one’s clients and a keen response to their demands.

For example, satellite photos with 22m/px resolution are enough for precision farming, but it is the spectral range of provided data that plays a critical role.

More services for more customers

The possibility that the SSC market will turn into a bubble that will burst before 2020 cannot be excluded

New market players are forced to be more considerate in their response to consumer demand. Therefore, the consumer indirectly influences the constellation’s composition. Based on that, it can be argued that new business models are configured by the market, the consumer, and the type of services a company provides.

Increasing small spacecraft capabilities creates many new options for their potential use. ERS is the main trend in microsatellite startups, while large companies pursuing other goals declared their plans to build massive SSC constellations in 2014.

Giants such as Facebook and Google announced their plans to provide satellite broadband internet, and SpaceX announced the creation of a Seattle branch that will work on SSC development. It is assumed that the spacecraft will be sought by Google, which will invest up to 10 billion dollars in SpaceX.

It could be argued that ultimately a large amount of service SSC constellations on the market will cause a quantum leap in new services, especially user-oriented ones.

Mining space

Speaking of small satellite use in the long run, companies such as Planetary Resources should be mentioned. It has already attracted a significant amount of investment, which shows us that goals that have not been reached by traditional space industry – serviced space, mining – could theoretically be accomplished by companies that use small spacecraft in their projects.

Such companies are replacing space agencies by generating and subsequently commercialising technologies that are created through the development of such systems.

Bubble trouble

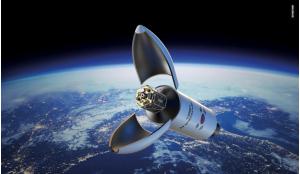

Conversion launch rockets such as Dnepr could help fill the need for more launchers, but they are limited in number

Nevertheless, companies that have decided to launch their own SSC must consider the risks that come at this stage of a developing market. The possibility that the SSC market will turn into a bubble that will burst before 2020 and bankrupt a large number of companies cannot be excluded.

Also, despite the fact that SSCs lower the space market entry threshold, start-ups still need a significant amount of funding. At this point the number of venture investors ready to work with start-ups in space business remains low.

The reason behind this is the lack of understanding of space technology and services, dynamics and potential among market investors. The forecasts say that trying out new business models and increasing the number of players on the market will increase the number of investors interested in space business.

PW-Sat, billed as the first Polish student satellite

Currently, the most common way for investors to “exit” investing in private space companies is through takeover deals with larger companies from complementary economy sectors, such as telecommunications and information technology.

The challenge of processing data

The creation of large spacecraft constellations presents new technological challenges that stem from the increased received data flow. Received data must be processed.

Hence the development of software aimed at high-speed (including on-board) processing of large amounts of data received from different spacecraft, fitted with varying payloads. Therefore, space activity is following the general trend of information technology development, i.e. “big data” use.

Lengthy licensing procedures and a poorly developed legal base are other major problems that stall the development of space business in Russia

It’s possible that the increase of low-cost constellations will cause a quantum leap, when the development of software services will become a priority for retaining a company’s competitive edge - rather than the technological upgrade of spacecraft portions of the orbital segment: iterative improvement of the software package is quicker, less costly, and in the end, increases space business profitability.

Orbit clutter

Another problematic point is the increase of space debris. The launch of constellations made up of tens or hundreds of SSCs that have a short active lifespan (because of the use of cheap commercial/industrial components), that aren’t equipped with engine units (and therefore lacking the ability to manoeuvre) can increase the probability of space collisions.

Most countries have laws that prevent the accumulation of space debris, which ensure that such spacecraft are launched into low orbits, so that a certain period of time after their active duty ends (not more than 25 years), they burn up in the endoatmosphere.

Nevertheless, considering hundreds of spacecraft in similar orbit, this time period may still be too long to fully take care of the problem.

Where to find launchers?

A major problem for small spacecraft is the dependency of their launch on preparation and launch schedules of “large” spacecraft. Since most SSCs are launched simultaneously, they must conform to the existing agency or large operator launch schedule.

The situation is exacerbated by the heavy need to renew microsatellite constellations – a large amount of required launches for each one. Therefore, there is an objective need for launch rockets for SSC launches.

Conversion launch rockets such as Dnepr that do a cluster launch of many SSCs at once could ameliorate the situation, but they’re limited in number. A decision to launch from the ISS is limited by delivery of load volume to the station. Therefore, the appearance of new market niches for light launch rockets can become the natural result of SSC business development.

Unique problems for Russia

Russian small spacecraft developers and operators face a number of additional problems. Firstly, access to the frequency range. S-band, typically used by SSC operators abroad, and the de facto standard for these types of spacecraft, is unavailable in Russia, because it’s used for military needs.

Russian microsatellite developers suffer additional problems such as a lack of domestic components

So there’s a need to switch to a different frequency, which naturally results in higher costs and prevents Russian companies from using standardised solutions and data transmission channels, including – to the final consumer.

Secondly, a natural problem that Russian microsatellite developers encounter is the lack of domestic components with the required characteristics. Purchasing foreign-made components often runs up against regulatory problems.

Despite the recent reform of American export control system ITAR, the sale of components outside of the US still requires licensing through the US Department of Defence or Department of Commerce. Because of this, Russian companies are faced with the issue of the import ratio for components used in building spacecraft. It is currently impossible to completely phase out imported materials.

Lengthy licensing procedures and a poorly developed legal base are other major problems that stall the development of space business in Russia. But thanks to the efforts of certain market players, the situation is improving. Thus, limitations on high-resolution data distribution are gradually being lifted, and licensing procedures for space activity are being simplified.

Finally, university teams that eventually become microsatellite businesses are not very common. Despite a significant amount of more or less widely broadcast announcements, there are few worthwhile university projects and their planned lengths typically exceed any reasonable amount of time.

To sum up, it should be noted that small spacecraft are not goals in and of themselves. This is one of the ways new businesses with new types of relatively low-cost business models can enter the market occupied by large vertically integrated companies. The prospects of using small spacecraft are directly related to improving serial production, increasing market-oriented data flow and creating new applications, adapted to specific users.

References

1 Small spacecraft market research, retrospective from 2002-2013 and with forecasts until 2020.// 02 Consulting, M, 2014.

2 Elizabeth Buchen: SpaceWorks’ 2014 Nano/Microsatellite Market Assessment//28th Annual AIAA/USU Conference on Small Satellites

3 Robert H. Meurer Seah, Peng Hwee: Global Commerce in Small Satellites:Trends and New Business Models// 28th Annual AIAA/USU Conference on Small Satellites

4 Daniel Terdiman “Google said to be in talks to invest in SpaceX at $10B valuation”//Venturebeat 19.01.2015 http://venturebeat.com/2015/01/19/google-said-in-t...

5 https://www.crunchbase.com/organization/planetary-...