This article identifies some of the most important incentives to attract entrepreneurship that are embodied in national space laws, in particular from Australia, France, the United Kingdom (UK) and the United States (US), as well as considering states lacking a generic space law and the impact of other regulatory elements besides space legislation.

Several countries have enacted national space laws, which diverge in their substances largely as a result of the intrinsic characteristics and extent of the space activities carried out under the supervision of the state in question. As private firms willing to conduct space activities will be subject to the rules and regulations contained in those national space laws, it should not be a surprise that these private undertakings would wish to have a transparent, attractive, and incentivising regulatory framework applicable to them.

Given the massive costs and technicalities involved, the choice of regulatory framework may well be crucial for the success, profitability, and even survivability of a business. In like manner, states wish to have thriving industries within their borders for several reasons. These national space legislations are one of many means that states could possibly use to further the objective of attracting private capital to their territories.

The landscape at NASA Kennedy Space Center in Florida is gradually changing with commercial companies like Boeing and SpaceX appearing on once exclusively government territory.

The landscape at NASA Kennedy Space Center in Florida is gradually changing with commercial companies like Boeing and SpaceX appearing on once exclusively government territory.

Authorisation of space activities by the appropriate state is the first main aspect linked to the quest of finding incentives. All analysed states (Australia, France, the UK and the US) require certain licences to be obtained by space operators, the issuing of which is prefaced by an authorisation process. Practices and procedures differ among states and incentives can be found in various forms.

To start, the UK offers flexibility with regard to the authorisation conditions: the detailed requirements to be complied with are not fixed on beforehand, but rather decided by the authority for each specific application by including them in the actual licence. Private firms could see this as beneficial since it means that the conditions will most likely take into account the specifics of each space activity and will be adapted to them accordingly. It also gives the impression that a dialogue with the authorising authority would be possible when determining the authorisation conditions.

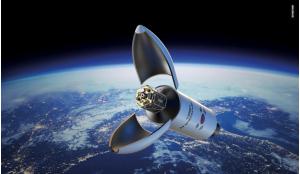

A concept for a space station using the B330 expandable space habitat manufactured by Bigelow Aerospace. The design was evolved from NASA’s TransHab habitat concept and B330 will have 330 cubic metres (12,000 cu/ ft) of internal space. The craft will support zero-gravity research including scientific missions, manufacturing processes, a destination for space tourism and a craft for missions destined for the Moon.

A concept for a space station using the B330 expandable space habitat manufactured by Bigelow Aerospace. The design was evolved from NASA’s TransHab habitat concept and B330 will have 330 cubic metres (12,000 cu/ ft) of internal space. The craft will support zero-gravity research including scientific missions, manufacturing processes, a destination for space tourism and a craft for missions destined for the Moon.

France on the other hand gives the opportunity to award space operators active in space on an ongoing basis an authorisation for a certain (longer) period, which can be an example of an incentive for private undertakings. This opportunity makes the authorisation process less cumbersome and it may even be waived for perpetual activities.

Australia offers its space licences for a period of up to 20 years, possibly lessening the authorisation burdens as well when compared to other states. The US is the only state to offer an ‘experimental permit’ with relaxed conditions for restricted types of activities, in order to give reusable suborbital launch operators the possibility to conduct tests without having to obtain a normal licence.

Talking about disincentives, space operators generally see uncertainties in administrative procedures (with the added uncertainty of actually obtaining a licence) and technical regulations to be complied with, as hurdles.

Exemptions from the necessity to obtain an authorisation would also be advantageous for private firms. The fact that Australia and the US give the opportunity for such an exemption if the relevant authorisation authority is satisfied that the space operation is safe, amounts to a certain flexibility that could come in handy when negotiating with the authorities to get a green light for their space activities.

Private firms could see nonregulation of space activities as beneficial

France also provides for exemptions in case of foreign launches where it deems the required conditions under the French national space law have been complied with. The UK, for its part, finds authorisation unnecessary when arrangements have been made with another state in order to secure compliance with the UK’s international obligations.

The second main element to be found in national space legislation that is linked to possible incentives are the financial obligations, consisting primarily of reimbursement and insurance. Most states embed a reimbursement requirement for private operators in their national space laws, because private operators causing damage trigger the international liability of their home state, meaning that the state is liable to pay damages on an international level.

This is why states mostly require the actual perpetrator (i.e. the private operator) to reimburse the state when faced with a damage claim. Keeping this reimbursement basis and the potential enormous damage claims in mind, it should be clear that when states put a cap on this reimbursement obligation, they give an incentive to their private industry: without the ceiling, private operators would in general be obliged to fully reimburse their government. Because of the inherent risks of space activities and the large uncertainties around accidents and damage resulting from space activities, it is likely that the extent of the damage for which compensation can be claimed is far above the financial capabilities of a single commercial entity.

In this regard, (financial) government support would become essential for commercial entities to realistically operate in space. Not only does this system provide financial incentives for space operators, but also provides clarity of their maximal risk and therefore eases the financing of the activity. This state guarantee is seen as instrumental for space operators as the removal of such a measure could be regarded as a ‘market killer’, because it provides a substantial level of financial assurance for the actors in question.

In Australia, France, and the US, such limitations of the reimbursement obligation can be seen. In France, this ceiling is currently set between €50 and €70 million. Any amount to be paid above this ceiling is taken care of by the French government, without limitation.

Similar provisions are in place in the US, but the US government inserted its own cap on that governmental guarantee, equal to US$1.5 billion. Australia also provides for a cap on the governmental guarantee (A$3 billion), but it only applies to claims regarding damage to Australian nationals, while in the US it applies to any claim. The UK has not put a cap on the reimbursement obligation: the full damage has to be indemnified by the space operator in case of international liability. This can definitely exceed the financial capabilities of the liable space operator and, by the same token, that of any private insurer. Given the potential for immense damage claims and the importance of financial certainty for private firms, this is a clear disincentive for space operators.

While obligatory insurances are definitely a burden on an undertaking, they are required in all of the discussed states. Because of their financial impact, they may have a considerable impact on the considerations that private space operators will make when deciding where to conduct their space activities.

The UK currently demands an insurance of ?100 million in practice. In France, the obligatory insurance is equal to the liability ceiling (currently set between €50 and €70 million). France goes a step further and gives the possibility of an exemption from the insurance obligations in case it is impracticable to obtain insurance for the period that satellites do not change their orbital position.

Australia obliges space operators to take up insurance for the lesser of either the ‘Maximum Probable Loss’ (MPL) or A$750 million. The MPL is based on losses that can reasonably be expected to occur from the licensed activity. The US has the most flexible regime, providing three possible options: the lowest of the MPL, the “maximum liability insurance available on the world market at a reasonable cost”, or US$500 million. This inclusion of the maximum liability insurance can be seen as an incentive by private firms, because it gives the assurance that an insurance can actually be obtained, due to the obligation being linked to what is actually and realistically obtainable in the insurance market (assuming that the insurance market can actually underwrite such an insurance).

When states put a cap on this reimbursement obligation, they give an incentive to private industry

Cross-waivers of liability are another form of incentive for private firms, whereby parties participating in space activities mutually agree to waive any damage claims against other participating parties and accept financial responsibility for damage resulting from the space activity. They are based on the principle that each party is to be held liable only for its share of responsibility. Cross-waivers of liability are mostly accompanied by a ‘hold harmless’ clause whereby the parties undertake to pass on the cross-waiver obligations onto their associate and interested parties. The French and American space laws provide for this practice on a statutory basis. At the time of introduction into American space law in 1988, this was considered the only viable alternative for the emergence of the American private launch industry. These cross-waivers create attractive conditions for space operators as they ease the potential financial (including insurance) burdens.

Virgin Galactic’s SpaceShipTwo craft alongside the signature feature of Spaceport America, the Gateway to Space building, which serves as a hangar and training centre. The New Mexico spaceport has been designed to fit within and be a part of the surrounding desert landscape.

Virgin Galactic’s SpaceShipTwo craft alongside the signature feature of Spaceport America, the Gateway to Space building, which serves as a hangar and training centre. The New Mexico spaceport has been designed to fit within and be a part of the surrounding desert landscape.

Private firms could see non-regulation of space activities (or certain parts of a space activity) as beneficial as it may lower administrative, technical, and financial burdens on their proposed space activity. However, a lack of national space legislation would probably mean that there would be no dedicated reimbursement or insurance obligation, which may sound quite attractive and favourable for space operators. Nevertheless, internationally liable governments would presumably not shy away from any legal means to recover the compensations done in view of their liability, especially given the (potentially enormous) damages involved.

General tort law, due diligence and wrongful act concepts come to mind to have international claims reimbursed by the actual perpetrator. This would be without any prior legal transparency and clarity that (mostly) would have been there in states with a specific national space law. Therefore, legal clarity and transparency can by themselves even serve as incentives to private space firms.

It is instructive to note that besides these incentives found in national space laws, other elements and incentives in different areas of law and policy should not be overlooked. On the contrary: they may be more decisive to private companies than the identified incentives in space legislation.

One fine example is the Isle of Man’s policy. This British Crown Dependency provides several advantages for private space undertakings found outside the UK’s space law, including zero per cent corporate tax and no insurance premium tax for satellite insurances. Consequently, it is worth mentioning that these benefits can de facto amount to considerable incentives for private firms to incorporate themselves in the Manx jurisdiction.

Similar measures can be found in some of the states of the US. When talking about the impact resulting from factors other than strict space legislation, mention should be made of the US’ export control regulations as well. In practice, these could constitute a not-to-be-neglected disincentive when space operators consider the trade in space components as a serious aspect of their business plan. In general, ‘forum shopping’ behaviour may not be caused by differences in national space laws, as more important fields of law (such as corporate law and tax law) are a greater driver in the decision-making process of where to establish a company.